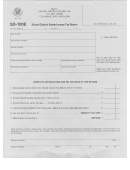

SD 100ES

School District Year 2013 Estimated Income Tax Payments

Rev. 10/12

Worksheet #1: Traditional Tax Base

Use this worksheet to determine your liability for school dis-

method of payment eliminates the need for you to fi le a paper

trict income tax due to a traditional tax base school district as

copy of Ohio form SD 100ES.

shown in the list on pages 3-4.

Credit Card – You may use your Discover/Novus, VISA, Master

If you fi led a school district income tax return for year 2012

Card or American Express card to pay your estimated school

and if you will be making estimates based on the “last year’s

district income taxes. You may make your credit card payments

tax” method, skip lines 1 through 8 and enter on line 9 below

by either visiting tax.ohio.gov or by calling 1-800-2PAY-TAX

100% of the tax shown on line 6 of the 2012 Ohio form SD 100.

(1-800-272-9829). The Ohio jurisdiction code is 6446. Offi cial

Payments charges a convenience fee equal to 2.5% (or $1,

Note 1: If you move during the year and you will be residing in more

whichever is greater). This fee is paid directly to Offi cial Payments

than one school district that imposes the school district income

Corporation and is based on the amount of your tax payment. Do

tax, then you will need to complete a separate worksheet for each

not fi le Ohio voucher form SD 100ES if you use the credit card

school district.

method of payment.

Note 2: You can avoid paying school district estimated income tax

Check or Money Order – If you do not want to use an electronic

if the sum of (i) your 2013 Ohio income tax withholding and (ii) your

check or credit card to make your payment, you may send in a

2013 school district income tax withholding and (iii) $500 is equal

personal check or money order made payable to the School District

to or greater than the sum of your 2013 Ohio income tax and your

Income Tax with your quarterly estimated Ohio form SD 100ES.

2013 school district income tax.

Mail to the address printed on the voucher. Do not send cash.

What Are My Payment Options?

Federal Privacy Act Notice

There are three payment options available to you:

Because we require you to provide us with a Social Security num-

ber, the Federal Privacy Act of 1974 requires us to inform you that

Electronic Check – Save time and postage by electronically fi ling

providing us with your Social Security number is mandatory. Ohio

and paying your 2013 quarterly estimates. Simply go to our Web

Revised Code sections 5703.05, 5703.057 and 5747.08 authorize

site at tax.ohio.gov for this electronic payment option. Using this

us to request this information. We need your Social Security number

in order to administer this tax.

1. Enter your year 2013 estimated Ohio adjusted gross income. To see how to compute

this amount, refer to your 2012 Ohio form IT 1040, line 3 .......................................................1.

2. Part-year/nonresident deduction. Enter the amount of income included on line 1 that

(

)

will be earned while a resident of another school district .........................................................2.

3. Estimated school district adjusted gross income. Subtract line 2 from line 1 and enter

the result here ..........................................................................................................................3.

4. Exemptions. Personal exemptions and dependent exemptions

X $1,700 ...................4.

5. Estimated school district taxable income. Subtract line 4 from line 3. This is the

estimated taxable income you will use to fi gure your estimated school district income tax

liability ......................................................................................................................................5.

6. School district tax. Multiply the school district estimated taxable income on line 5 by

the decimal rate that applies to your school district of residence. The rates are listed on

pages 3-4 .................................................................................................................................6.

7. Senior citizen credit. Enter the senior citizen credit of $50 if you (or your spouse, if fi ling

jointly) will be 65 by the end of the taxable year. You may claim a maximum of $50 per

return ........................................................................................................................................7.

8. School district tax after credits. Subtract line 7 from line 6 and enter here .........................8.

9. Multiply line 8 by 90% or enter 100% of the tax shown on line 6 of the 2012 Ohio

form SD 100 if you fi led a 2012 Ohio form SD 100 for this district ....................................9.

10. School district income tax to be withheld and year 2012 school district income tax over-

payment credited to year 2013. Exclude from your year 2012 overpayment any tax paid

after April 15, 2013 and treat such tax payment as a year 2013 estimated tax payment ......10.

11. School district estimated income tax due. Subtract line 10 from line 9 and enter here

(but not less than -0-). This is your estimated school district income tax liability ...................11.

12. Multiply the amount on line 11 by .25 and enter the result on this line. This is the

amount of each of your school district estimated quarterly payments ...................................12.

- 1 -

- 1 -

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8