Clear Form

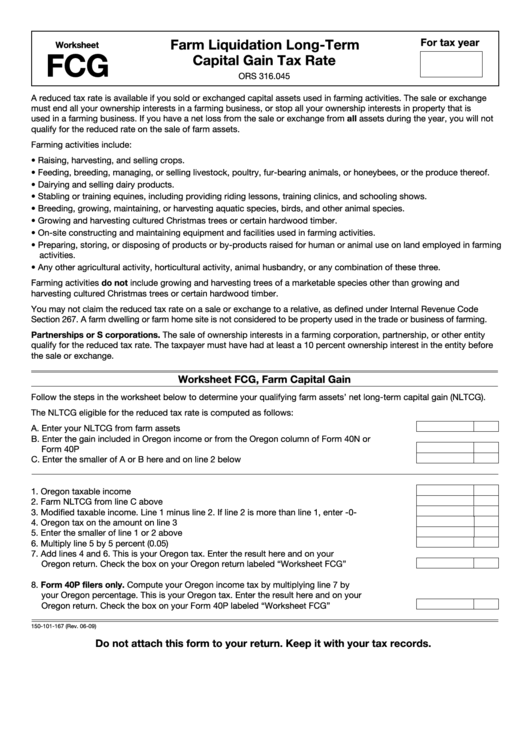

Farm Liquidation Long-Term

For tax year

Worksheet

FCG

Capital Gain Tax Rate

ORS 316.045

A reduced tax rate is available if you sold or exchanged capital assets used in farming activities. The sale or exchange

must end all your ownership interests in a farming business, or stop all your ownership interests in property that is

used in a farming business. If you have a net loss from the sale or exchange from all assets during the year, you will not

qualify for the reduced rate on the sale of farm assets.

Farming activities include:

• Raising, harvesting, and selling crops.

• Feeding, breeding, managing, or selling livestock, poultry, fur-bearing animals, or honeybees, or the produce thereof.

• Dairying and selling dairy products.

• Stabling or training equines, including providing riding lessons, training clinics, and schooling shows.

• Breeding, growing, maintaining, or harvesting aquatic species, birds, and other animal species.

• Growing and harvesting cultured Christmas trees or certain hardwood timber.

• On-site constructing and maintaining equipment and facilities used in farming activities.

• Preparing, storing, or disposing of products or by-products raised for human or animal use on land employed in farming

activities.

• Any other agricultural activity, horticultural activity, animal husbandry, or any combination of these three.

Farming activities do not include growing and harvesting trees of a marketable species other than growing and

harvesting cultured Christmas trees or certain hardwood timber.

You may not claim the reduced tax rate on a sale or exchange to a relative, as defined under Internal Revenue Code

Section 267. A farm dwelling or farm home site is not considered to be property used in the trade or business of farming.

Partnerships or S corporations. The sale of ownership interests in a farming corporation, partnership, or other entity

qualify for the reduced tax rate. The taxpayer must have had at least a 10 percent ownership interest in the entity before

the sale or exchange.

Worksheet FCG, Farm Capital Gain

Follow the steps in the worksheet below to determine your qualifying farm assets’ net long-term capital gain (NLTCG).

The NLTCG eligible for the reduced tax rate is computed as follows:

A. Enter your NLTCG from farm assets ..............................................................................................A

B. Enter the gain included in Oregon income or from the Oregon column of Form 40N or

Form 40P .......................................................................................................................................B

C. Enter the smaller of A or B here and on line 2 below ....................................................................C

1. Oregon taxable income .................................................................................................................1

2. Farm NLTCG from line C above .....................................................................................................2

3. Modified taxable income. Line 1 minus line 2. If line 2 is more than line 1, enter -0- ...................3

4. Oregon tax on the amount on line 3 ..............................................................................................4

5. Enter the smaller of line 1 or 2 above ............................................................................................5

6. Multiply line 5 by 5 percent (0.05) ..................................................................................................6

7. Add lines 4 and 6. This is your Oregon tax. Enter the result here and on your

Oregon return. Check the box on your Oregon return labeled “Worksheet FCG” ........................7

8. Form 40P filers only. Compute your Oregon income tax by multiplying line 7 by

your Oregon percentage. This is your Oregon tax. Enter the result here and on your

Oregon return. Check the box on your Form 40P labeled “Worksheet FCG” ..............................8

150-101-167 (Rev. 06-09)

Do not attach this form to your return. Keep it with your tax records.

1

1