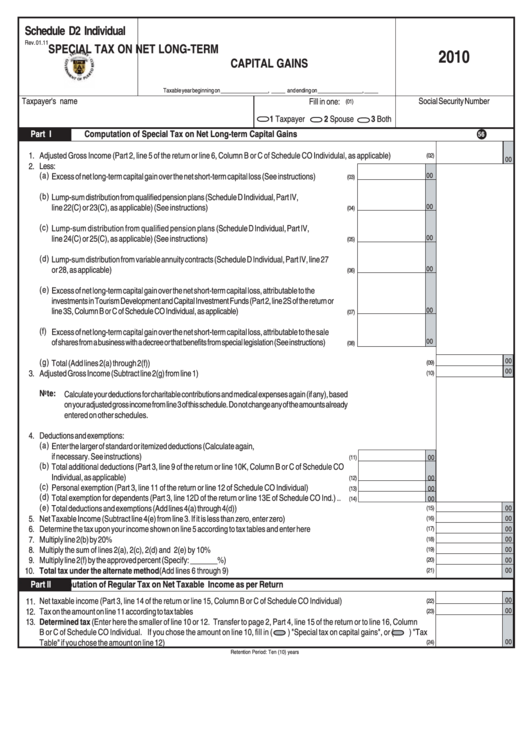

Schedule D2 Individual - Special Tax On Net Long-Term Capital Gains - 2010

ADVERTISEMENT

Schedule D2 Individual

Rev. 01.11

SPECIAL TAX ON NET LONG-TERM

2010

CAPITAL GAINS

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Fill in one:

(01)

1 Taxpayer

2 Spouse

3 Both

Part I

Computation of Special Tax on Net Long-term Capital Gains

56

NO INCLUYA CENTAVOS

1.

Adjusted Gross Income (Part 2, line 5 of the return or line 6, Column B or C of Schedule CO Individulal, as applicable) ............

(02)

00

Less:

2.

(a)

Excess of net long-term capital gain over the net short-term capital loss (See instructions) ............

00

(03)

(b)

Lump-sum distribution from qualified pension plans (Schedule D Individual, Part IV,

line 22(C) or 23(C), as applicable) (See instructions) ...................................................................

00

(04)

(c)

Lump-sum distribution from qualified pension plans (Schedule D Individual, Part IV,

line 24(C) or 25(C), as applicable) (See instructions) ............................................................

00

(05)

(d)

Lump-sum distribution from variable annuity contracts (Schedule D Individual, Part IV, line 27

or 28, as applicable) .....................................................................................................................

00

(06)

(e)

Excess of net long-term capital gain over the net short-term capital loss, attributable to the

investments in Tourism Development and Capital Investment Funds (Part 2, line 2S of the return or

line 3S, Column B or C of Schedule CO Individual, as applicable) .......................................................

00

(07)

(f)

Excess of net long-term capital gain over the net short-term capital loss, attributable to the sale

of shares from a business with a decree or that benefits from special legislation (See instructions) ........

00

(08)

00

(g)

Total (Add lines 2(a) through 2(f)) ........................................................................................................................................

(09)

00

3.

Adjusted Gross Income (Subtract line 2(g) from line 1) ................................................................................................................

(10)

Note:

Calculate your deductions for charitable contributions and medical expenses again (if any), based

on your adjusted gross income from line 3 of this schedule. Do not change any of the amounts already

entered on other schedules.

4.

Deductions and exemptions:

(a)

Enter the larger of standard or itemized deductions (Calculate again,

if necessary. See instructions) .......................................................................................................

00

(11)

(b)

Total additional deductions (Part 3, line 9 of the return or line 10K, Column B or C of Schedule CO

Individual, as applicable) ..............................................................................................................

00

(12)

(c)

Personal exemption (Part 3, line 11 of the return or line 12 of Schedule CO Individual) ................

(13)

00

(d)

Total exemption for dependents (Part 3, line 12D of the return or line 13E of Schedule CO Ind.) ..

00

(14)

(e)

Total deductions and exemptions (Add lines 4(a) through 4(d)) ...........................................................................................

00

(15)

5.

Net Taxable Income (Subtract line 4(e) from line 3. If it is less than zero, enter zero) ..................................................................

(16)

00

6.

Determine the tax upon your income shown on line 5 according to tax tables and enter here .....................................................

00

(17)

7.

Multiply line 2(b) by 20% ..........................................................................................................................................................

(18)

00

Multiply the sum of lines 2(a), 2(c), 2(d) and 2(e) by 10% .......................................................................................................

8.

(19)

00

9.

Multiply line 2(f) by the approved percent (Specify: _______%) ................................................................................................

00

(20)

10.

Total tax under the alternate method (Add lines 6 through 9) ..............................................................................................

(21)

00

Part II

Computation of Regular Tax on Net Taxable Income as per Return

Net taxable income (Part 3, line 14 of the return or line 15, Column B or C of Schedule CO Individual) .....................................

11.

00

(22)

12.

Tax on the amount on line 11 according to tax tables .................................................................................................................

00

(23)

Determined tax (Enter here the smaller of line 10 or 12. Transfer to page 2, Part 4, line 15 of the return or to line 16, Column

13.

B or C of Schedule CO Individual. If you chose the amount on line 10, fill in (

) "Special tax on capital gains", or (

) "Tax

Table" if you chose the amount on line 12) .............................................................................................................................

00

(24)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1