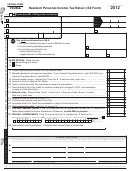

Arizona Form 140ez - Resident Personal Income Tax Return - 2013 Page 29

ADVERTISEMENT

Y

F

A

OU MAY QUALIFY TO FILE YOUR

EDERAL AND

RIZONA INDIVIDUAL

FREE!!!

INCOME TAX RETURNS FOR

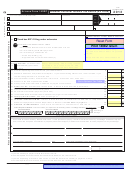

Go to our website at and

click on the Free File logo.

BE SURE TO USE TO ACCESS YOUR PREFERRED SOFTWARE

VENDOR TO ENSURE FREE FILING FOR YOUR FEDERAL AND STATE RETURNS.

Do-It-Yourself using the Internet

Free Federal and State Tax

Preparation for taxpayers who are:

x Elderly

x Americans with Disabilities

x Low Income

For Locations, call 211

or go to

Faster refunds when you

e-File and select the

Direct Deposit option!

Up to

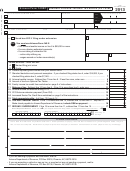

DO YOU QUALIFY FOR AN ARIZONA TAX CREDIT?

$100

per household

You may claim the FAMILY TAX CREDIT if:

You may claim the INCREASED EXCISE TAX CREDIT if:

‚ your income is $31,000 or less for Married Filing Joint

‚ you are an Arizona resident

‚ your income is $26,575 or less for Head of Household

‚ you are not claimed as a dependent by any other taxpayer

‚ your income is $10,000 or less for Single

‚ your federal adjusted gross income was $ 25,000 or less ($12,500 if single)

‚ you were not sentenced for at least 60 days of 2013 to a county, state or

U

$240

P TO

federal prison

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32