KANSAS DEPARTMENT OF REVENUE

COMPLIANCE MANAGEMENT - AUDIT SERVICES

ATTN: LIQUOR AUDITING

915 S.W. HARRISON STREET

TOPEKA, KANSAS 66625-7719

Email: LiquorReport.Audit@kdor.ks.gov

MONTHLY REPORT OF ON-PREMISE SALES*

INSTRUCTIONS

WHO IS REQUIRED TO FILE THIS REPORT?

Retail Liquor Stores, Distributors and Farm Wineries who sell alcoholic liquor to licensees for consumption on the licensed

premise are required to file a monthly sales report by the due date.

•

Retail Liquor Stores who possess a Basic Permit report their sales to Clubs, Caterers, Drinking Establishments,

Public Venue and Temporary Permit holders. K.A.R. 14-13-10

•

Distributors that do not file electronically must report their sales to Retail Liquor Stores, Clubs, Caterers,

Drinking Establishments, Public Venue and Temporary Permit holders. K.S.A. 41-601

•

Farm Wineries that self-distribute must report their sales to Clubs, Caterers, Drinking Establishments, Public

Venue and Temporary Permit holders. K.S.A. 41-601

DUE DATE:

th

This monthly report is due on or before the 15

day of the calendar month following the month in which the alcoholic liquor

was sold. You are required to file this report even if you have no sales to report.

INSTRUCTIONS TO COMPLETE THE MONTHLY REPORT OF ON-PREMISE SALES:

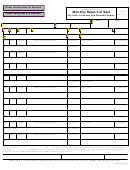

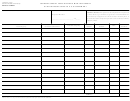

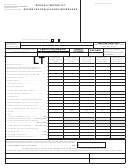

1. Complete the month, year, FEIN, license number and your Basic Permit number.

2. Complete licensee name, demographic and contact information.

3. If you have no sales to report, check the box by “I have no sales to report this month” and file your report.

4. To report sales to licensees, complete information for each license type as follows:

A. Licensee Name. Enter the name of each licensee you have sold to.

B. License Number. Enter the license number for each licensee you have sold alcoholic liquor to.

C. Date of Sale. Enter the date you sold the alcoholic liquor to each licensee.

D. Total Amount of Sale. Enter the total dollar amount of the sale for each licensee.

5. Sign, date and enter your title on the form.

6. Make a copy of the report and retain for your records.

NO SALES:

You are required to file this report even if you have no sales to report. Complete the month, year, FEIN, license number,

Basic Permit number and Licensee name and demographic information. Check the box next to “I have no sales to report

this month.”

FILING OF THE MONTHLY REPORT OF ON-PREMISE SALES:

After completing all required information, file the original copy of the Monthly Report of On-Premise Sales with the Kansas

Department of Revenue. It is preferred that you file your report by email to LiquorReport.Audit@kdor.ks.gov or you may

mail your report at the address provided at the top of the form.

CONTACT INFORMATION:

Questions may be directed to the Audit Services Bureau by email to LiquorReport.Audit@kdor.ks.gov

*On-premise sales includes sales to Class A Clubs, Class B Clubs, Drinking Establishments (including railway cars), Hotel/Drinking Establishments,

Caterers, Drinking Establishment/Caterer, Public Venue and Temporary Permit holders.

ABC-73 (Rev.7.1.12)

1

1 2

2