Trust Agreement Template

ADVERTISEMENT

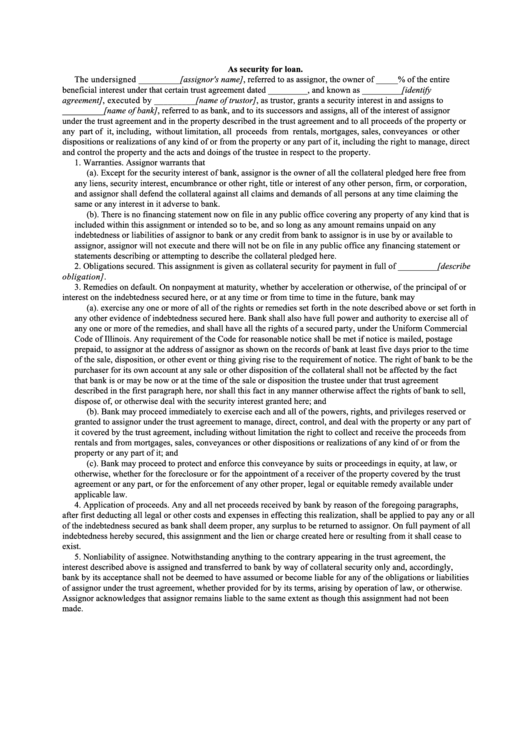

As security for loan.

The undersigned _________[assignor's name], referred to as assignor, the owner of _____% of the entire

beneficial interest under that certain trust agreement dated _________, and known as _________[identify

agreement], executed by _________[name of trustor], as trustor, grants a security interest in and assigns to

_________[name of bank], referred to as bank, and to its successors and assigns, all of the interest of assignor

under the trust agreement and in the property described in the trust agreement and to all proceeds of the property or

any part of it, including, without limitation, all proceeds from rentals, mortgages, sales, conveyances or other

dispositions or realizations of any kind of or from the property or any part of it, including the right to manage, direct

and control the property and the acts and doings of the trustee in respect to the property.

1. Warranties. Assignor warrants that

(a). Except for the security interest of bank, assignor is the owner of all the collateral pledged here free from

any liens, security interest, encumbrance or other right, title or interest of any other person, firm, or corporation,

and assignor shall defend the collateral against all claims and demands of all persons at any time claiming the

same or any interest in it adverse to bank.

(b). There is no financing statement now on file in any public office covering any property of any kind that is

included within this assignment or intended so to be, and so long as any amount remains unpaid on any

indebtedness or liabilities of assignor to bank or any credit from bank to assignor is in use by or available to

assignor, assignor will not execute and there will not be on file in any public office any financing statement or

statements describing or attempting to describe the collateral pledged here.

2. Obligations secured. This assignment is given as collateral security for payment in full of _________[describe

obligation].

3. Remedies on default. On nonpayment at maturity, whether by acceleration or otherwise, of the principal of or

interest on the indebtedness secured here, or at any time or from time to time in the future, bank may

(a). exercise any one or more of all of the rights or remedies set forth in the note described above or set forth in

any other evidence of indebtedness secured here. Bank shall also have full power and authority to exercise all of

any one or more of the remedies, and shall have all the rights of a secured party, under the Uniform Commercial

Code of Illinois. Any requirement of the Code for reasonable notice shall be met if notice is mailed, postage

prepaid, to assignor at the address of assignor as shown on the records of bank at least five days prior to the time

of the sale, disposition, or other event or thing giving rise to the requirement of notice. The right of bank to be the

purchaser for its own account at any sale or other disposition of the collateral shall not be affected by the fact

that bank is or may be now or at the time of the sale or disposition the trustee under that trust agreement

described in the first paragraph here, nor shall this fact in any manner otherwise affect the rights of bank to sell,

dispose of, or otherwise deal with the security interest granted here; and

(b). Bank may proceed immediately to exercise each and all of the powers, rights, and privileges reserved or

granted to assignor under the trust agreement to manage, direct, control, and deal with the property or any part of

it covered by the trust agreement, including without limitation the right to collect and receive the proceeds from

rentals and from mortgages, sales, conveyances or other dispositions or realizations of any kind of or from the

property or any part of it; and

(c). Bank may proceed to protect and enforce this conveyance by suits or proceedings in equity, at law, or

otherwise, whether for the foreclosure or for the appointment of a receiver of the property covered by the trust

agreement or any part, or for the enforcement of any other proper, legal or equitable remedy available under

applicable law.

4. Application of proceeds. Any and all net proceeds received by bank by reason of the foregoing paragraphs,

after first deducting all legal or other costs and expenses in effecting this realization, shall be applied to pay any or all

of the indebtedness secured as bank shall deem proper, any surplus to be returned to assignor. On full payment of all

indebtedness hereby secured, this assignment and the lien or charge created here or resulting from it shall cease to

exist.

5. Nonliability of assignee. Notwithstanding anything to the contrary appearing in the trust agreement, the

interest described above is assigned and transferred to bank by way of collateral security only and, accordingly,

bank by its acceptance shall not be deemed to have assumed or become liable for any of the obligations or liabilities

of assignor under the trust agreement, whether provided for by its terms, arising by operation of law, or otherwise.

Assignor acknowledges that assignor remains liable to the same extent as though this assignment had not been

made.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2