Decedent’s Last Name

*171911200*

Social Security Number

* 1 7 1 9 1 1 2 0 0 *

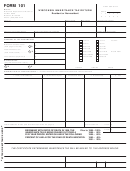

Amount from Line 7 _____________________________

0.00

VERMONT APPORTIONMENT CALCULATION

8.

. . . . . . . . 8. ________________________

Vermont Gross Estate (see instructions) .

9.

Value of gifts included on Line 2b with a

Vermont situs (see instructions) . . . . . . . . . . . . . .

. 9. ________________________

10.

Add Lines 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . 10. _______________________

11.

Federal Gross Estate

(from Federal Form 706, Line 1) . . . . . . . . . . . . . 11. ________________________

12.

Total value of all gifts reported on Line 2b .

. . . . . 12. ________________________

13.

Add Lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. _______________________

14.

Divide Line 10 by Line 13 (round to four decimal places) . . . . . . . . . . . . . . . . . . . . 14. _______________________

TAX DUE

15.

Vermont Estate Tax (multiply Line 7 by Line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . 15. _______________________

16.

Percentage of Vermont Estate Tax due to Vermont . Enter “100 .00%” or, if this

.

%

is an estate of a qualifying farmer, percentage from Schedule EST-192, Line 3 . . . 16. _______________________

100.00

17.

Adjusted Vermont Estate Tax (Multiply Line 15 by Line 16) . . . . . . . . . . . . . . . . . 17. _______________________

18.

Prior tax payments to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. _______________________

19.

REFUND. If Line 17 is less than Line 18, subtract Line 17 from Line 18 . . . . . . . 19. _______________________

20.

AMOUNT DUE. If Line 17 is more than Line 18, subtract Line 18 from

Line 17 . Make check payable to Vermont Department of Taxes. . . . . . . . . . . . . . 20. _______________________

DECLARATION OF FIDUCIARY

I hereby certify this return is true, correct, and complete to the best of my knowledge . Preparers cannot use return information for

purposes other than preparing returns .

Date

Daytime Telephone Number

SIGN

HERE

Check here if authorizing the Vermont Department of Taxes to discuss this return and attachments with your preparer .

Preparer’s

Date

Daytime Telephone Number

Preparer’s

signature

Use Only

Address

City, State, ZIP Code

Make checks payable to Vermont Department of Taxes and mail this return to:

Vermont Department of Taxes

Form EST-191

133 State Street

(formerly E-1)

Montpelier, VT 05633-1401

Page 2 of 2

5454

Rev. 10/17

Clear ALL fields

Save and Print

Save and go to Important Printing Instructions

1

1 2

2