Instructions

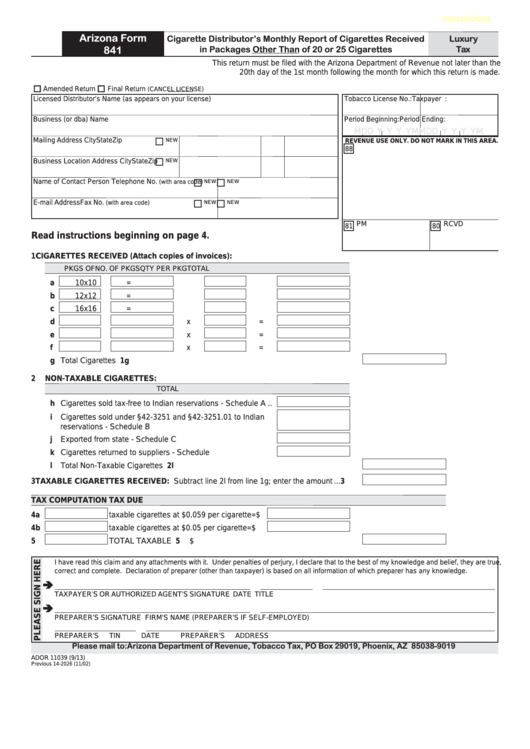

Arizona Form

Cigarette Distributor’s Monthly Report of Cigarettes Received

Luxury

in Packages Other Than of 20 or 25 Cigarettes

Tax

841

This return must be filed with the Arizona Department of Revenue not later than the

20th day of the 1st month following the month for which this return is made.

Amended Return

Final Return

(CANCEL LICENSE)

Licensed Distributor’s Name (as appears on your license)

Tobacco License No.:

Taxpayer I.D. No.:

Business (or dba) Name

Period Beginning:

Period Ending:

M

M D D Y Y Y Y

M

M D D Y Y Y Y

Mailing Address

City

State Zip

NEW

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Business Location Address

City

State Zip

NEW

Name of Contact Person

Telephone No.

NEW

(with area code)

NEW

E-mail Address

Fax No.

NEW

(with area code)

NEW

81 PM

80 RCVD

Read instructions beginning on page 4.

1

CIGARETTES RECEIVED (Attach copies of invoices):

PKGS OF

NO. OF PKGS

QTY PER PKG

TOTAL

a

10

x

10

=

b

12

x

12

=

c

16

x

16

=

d

x

=

e

x

=

f

x

=

g Total Cigarettes Received............................................................................................ 1g

2

NON-TAXABLE CIGARETTES:

TOTAL

h Cigarettes sold tax-free to Indian reservations - Schedule A ..

i

Cigarettes sold under §42-3251 and §42-3251.01 to Indian

reservations - Schedule B ......................................................

j

Exported from state - Schedule C ..........................................

k Cigarettes returned to suppliers - Schedule D........................

l

Total Non-Taxable Cigarettes ...................................................................................... 2l

3

TAXABLE CIGARETTES RECEIVED: Subtract line 2l from line 1g; enter the amount ... 3

TAX COMPUTATION

TAX DUE

4a

taxable cigarettes at $0.059 per cigarette = $

4b

taxable cigarettes at $0.05 per cigarette

= $

5

TOTAL TAXABLE CIGARETTES........................................................... 5

$

I have read this claim and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true,

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

TAXPAYER’S OR AUTHORIZED AGENT’S SIGNATURE

DATE

TITLE

PREPARER’S SIGNATURE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PREPARER’S TIN

DATE

PREPARER’S ADDRESS

Please mail to: Arizona Department of Revenue, Tobacco Tax, PO Box 29019, Phoenix, AZ 85038-9019

ADOR 11039 (9/13)

Previous 14-2026 (11/02)

1

1 2

2 3

3 4

4