Instructions

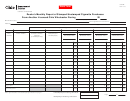

GENERAL INSTRUCTIONS:

Lines 1d through 1f: Enter the number of packages of

the different number of cigarettes per pack and multiply

You must fi le this return and pay the luxury tax if you are

by that number. Enter the actual number of cigarettes on

a distributor of cigarettes in packages of other than 20 or

lines 1d through 1f.

25 cigarettes within the state of Arizona.

Line 1g: Add lines 1a through 1f. Enter the total cigarettes

You must fi le this return monthly and pay the tax on or

received.

before the 20th day after the month the tax accrues.

Line 2h: On Schedule A, enter any tax-free sales to your

Prepare this return for each month regardless of whether

customers on the Indian reservation during the month.

or not any tax is due. File the original with the Arizona

The sale must be in the ratios provided to you by the

Department of Revenue. Retain a copy of the form with

Department. Enter the totals from Schedule A on page 1,

all substantiating documentation for at least four years,

line 2h. You may substitute a computer-generated list for

subject to inspection by the Department.

the actual schedule.

You must provide your tobacco license number.

Line 2i:

On Schedule B, enter any sales to your

customers on the Indian reservation at the rate indicated

You must provide your taxpayer identifi cation number on

in §42-3251 and §42-3251.01 during the month. The sale

the form. A taxpayer identifi cation number is either your

must be in the ratios provided to you by the Department.

Federal Employer Identifi cation Number (EIN) or your

Enter the totals from Schedule B on page 1, line 2i. You

Social Security Number (SSN), if you are a sole proprietor

may substitute a computer-generated list for the actual

with no employees.

schedule.

The Licensee or Authorized Agent must sign the form.

Line 2j: On Schedule C, enter any sales made out of

state during the month. Enter the totals from Schedule

If you pay a preparer to complete this return, the preparer

C on page 1, line 2j. You may substitute a computer-

must sign the form and include his or her identifi cation

generated list for the actual schedule.

number.

Line 2k: On Schedule D, enter any product returned

Send payment with the return to the Arizona Department

to suppliers during the month.

Enter the totals from

of Revenue. Include your taxpayer identifi cation number

Schedule D on page 1, line 2k. You may substitute a

on your check.

computer-generated list for the actual schedule.

State law imposes a 10% penalty plus interest of the

Line 2l: Add lines 2h through 2k. Enter the total here.

amount of tax due on each return if your payment is late.

State law imposes a 5% penalty per month if you fail to

Line 3: Subtract line 2l from 1g. Enter the total here.

fi le. The combined penalties, however, cannot exceed

25%.

Line 4a: Enter the number of taxable cigarettes from line

3 and multiply by the rate per cigarette of $0.059. Enter

SPECIFIC INSTRUCTIONS:

the tax due.

ATTACH COPIES OF ALL PURCHASE INVOICES.

Line 4b: Enter the number of cigarettes from line 2i and

Line 1a: Enter the number of packages of 10 cigarettes

multiply by the rate per cigarettes $0.05. Enter the tax

per pack and multiply by 10. Enter the actual number of

due.

cigarettes on line 1a.

Line 5: Add lines 4a and 4b to calculate the total taxable

Line 1b: Enter the number of packages of 12 cigarettes

cigarettes and the total tax due.

per pack and multiply by 12. Enter the actual number of

cigarettes on line 1b.

Line 1c: Enter the number of packages of 16 cigarettes

per pack and multiply by 16. Enter the actual number of

cigarettes on line 1c.

ADOR 11039 (9/13)

Arizona Form 841

Page 4 of 4

Previous 14-2026 (11/02)

1

1 2

2 3

3 4

4