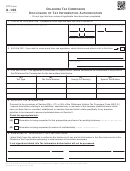

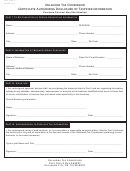

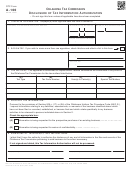

Form A-100

General Instructions

Purpose of Form

Form A-100 authorizes any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your

confidential information of the Oklahoma Tax Commission for the type of tax and the years or periods you list.

Form A-100 does not authorize your appointee to advocate your position with respect to the tax laws; to execute waivers,

consents, or closing agreements; or to otherwise represent you before the Oklahoma Tax Commission. If you want to authorize an

individual to represent you, use Form BT129, Power of Attorney.

When To File

Form A-100 must be received by the Oklahoma Tax Commission within 30 days of the date it was signed and dated by the tax-

payer.

Revocation of an Existing Tax Information Authorization

If you want to revoke an existing tax information authorization and do not want to name a new appointee, send a copy of the pre-

viously executed tax information authorization to the Oklahoma Tax Commission. The copy of the tax information authorization must

have a current signature and date under the original signature on line 5 with “REVOKE” written across the top of the form. If you do

not have a copy of the tax information authorization and you want to revoke, send a statement to the Oklahoma Tax Commission.

The statement of revocation or withdrawal must indicate that the authority of the appointee is revoked, list appointee, tax matters

and periods. The statement must be signed and dated by the taxpayer and or representative. If the appointee is withdrawing, list the

name, Social Security Number (SSN) / Employee Identification Number (EIN), and address (if known) of the taxpayer.

Appointee Address Change

If the appointee’s address has changed, a new Form A-100 is not required. The appointee can send a written notification that

includes the new information and their signature to the Oklahoma Tax Commission.

Specific Instructions

Section 1. Taxpayer Information

Individuals. Enter your name, Social Security Number (SSN)/Employer Identification Number (EIN), and your street address in

the space provided. Do not enter your appointee’s address or post office box. If a joint return is used, also enter your spouse’s name

and SSN.

Corporations, Partnerships, or Associations. Enter the name, EIN, and business mailing address.

Trust. Enter the name, title, and address of the trustee, and the name and EIN of the trust.

Estate. Enter the name, title, and address of the decedent’s executor/personal representative, and the name and identification

number of the estate. The identification number for an estate includes both the EIN, if the estate has one, and the decedent’s SSN.

Section 2. Appointee

If you want to name more than one appointee, indicate so on this line and attach a list of appointees to Form A-100.

Enter your appointee’s full name. Use the identical full name on all submission and correspondence.

Enter the appointee’s telephone number and fax number for each appointee.

Section 3. Tax Matters

Enter the type of tax, the tax form number, the years or periods, and the specific tax matter. Enter “Not Applicable” in any of the

columns that do not apply.

For example, you may list “Income, 511” for calendar year “2006.” For multiple years or a series of inclusive periods, including

quarterly periods, you may list 2004 through (thru or a hyphen) 2006. For example, “2004 thru 2006” or “2nd 2005 - 3rd 2006.” For

fiscal years, enter the ending year and month, using the YYYYMM format. Do not use a general reference such as “All years,” “All

periods,” or “All taxes.” Any tax information authorization with a general reference will not be processed.

You may list the current year or period and any tax years or periods that have already ended as of the date you sign the tax in-

formation authorization. You must enter the type of tax, the tax form number, and the future year(s) or period(s). If the matter relates

to estate tax, enter the date of the decedent’s death instead of the year or period.

In Column (D), enter any specific information you want the Oklahoma Tax Commission to provide. Examples of Column (D)

information are; lien information, a balance due amount, a specific tax schedule, or a tax liability.

Section 4. Disclosure of Tax Information

(A) Check this box if information is being disclosed pursuant to Title 68, Section 205 c (24). A copy of the purchase contract

must be attached.

(B) Check this box if information is being disclosed pursuant to Title 68, Section 205 c (17).

Section 5. Signature of Taxpayer(s)

If tax matter applies to a joint return, either husband or wife must sign. If signed by a corporate officer, partner, guardian, execu-

tor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the Authority to execute this form with respect

to the tax matters/periods in Section 3 above.

1

1 2

2