Clear ALL fields

Important Printing Instructions

Print

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*14E011100*

Phone: (802) 828-6820

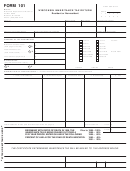

ESTATE TAX RETURN

VT Form

E-1

* 1 4 E 0 1 1 1 0 0 *

Resident and Nonresident

This form applies only to estates of decedents who died after December 31, 2008 and before January 1, 2016.

Last Name of Decedent

First Name

Initial

Social Security Number

State of Domicile at Time of Death

Date of Death

Fiduciary’s Name and Address

Attorney’s Name and Address

A. This section is for estates of Vermont Resident Decedents where all of the decedent’s property is

located in Vermont.

Estate Tax due from Schedule A, Line 6 on the back of this form. Please remit this amount. . . . . A.

B. This section is for estates of Vermont Resident Decedents where the decedent’s property is located in

Vermont and in other states. (Please use computation Schedule B on the back of this form.)

Estate Tax due from Schedule B, Line 8 on back of this form. Please remit this amount. . . . . . . . B.

C. This section is for estates of Nonresident Decedents where the decedent’s property is located in

Vermont and in other states. (Please use computation Schedule C on the back of this form.)

Estate Tax due from Schedule C, Line 13 on back of this form. Please remit this amount. . . . . . . C.

D. Prior tax payments to Vermont . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D. __________________

E. If Line D is greater than Line A, B, or C, subtract Line A, B, or C from Line D.

This is the amount to be refunded to you. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E. __________________

F. If Line D is less than Line A, B, or C, subtract Line D from Line A, B, or C.

This is the amount you owe. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F. __________________

DECLARATION OF FIDUCIARY

I hereby certify this return is true, correct and complete to the best of my knowledge. Preparers cannot use return information for

purposes other than preparing returns.

Date

Telephone Number

SIGN

HERE

Check here if authorizing the VT Department of Taxes to discuss this return and attachments with your preparer.

Preparer’s

Date

Telephone Number

Preparer’s

signature

Use Only

Address

City, State, ZIP Code

Make checks payable to VERMONT DEPARTMENT OF TAXES and mail this form to:

Vermont Department of Taxes

133 State Street

Form E-1

Montpelier, VT 05633-1401

5454

Rev. 06/16

1

1 2

2 3

3