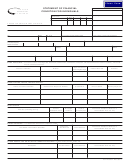

700-U

CALIFORNIA

Instructions for Completing

FORm

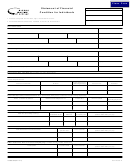

Form 700-U (continued)

What is a travel Payment?

•

A travel payment that was received from a non-profit

entity exempt from taxation under Internal Revenue

Travel payments include advances and reimbursements for

Service Code Section 501(c)(3) for which you provided

travel and related expenses, including lodging and meals.

equal or greater consideration, such as reimbursement

•

Travel payments are gifts if you did not provide

for travel on business for a 501(c)(3) organization for

services which were equal to or greater in value than

which you are a board member.

the payments received. You must disclose gifts totaling

Check the box to indicate if the payment was a gift or

$50 or more from a single source during the period

income, report the amount, and disclose the date(s) if

covered by the statement. Gifts of travel are reportable

applicable.

without regard to where the donor is located.

Violations

When reporting travel payments which are gifts, you

must provide a description of the gift and the date(s)

Failure to file the required Statement of Economic Interests

received. In addition, the travel destination must be

or failure to report a financial interest may subject a

disclosed for travel taken on or after January 1, 2016.

principal investigator to civil liability, including fines, as well

as University discipline. (See Gov. Code Sections 81000-

•

Travel payments are income if you provided services

91014.)

which were equal to or greater in value than the

payments received. You must disclose income totaling

Privacy Information Notice

$500 or more from a single source during the period

Information requested on all FPPC forms is used by the

covered by the statement. The filer has the burden of

FPPC to administer and enforce the Political Reform

proving the payments are income rather than gifts.

Act (Gov. Code Sections 81000-91014 and Regulations

When reporting travel payments as income, you must

18110-18997). All information required by these forms is

describe the services you provided in exchange for the

mandated by the Political Reform Act. Failure to provide all

payment. You are not required to disclose the date(s)

of the information required by the Act is a violation subject

for travel payments which are income.

to administrative, criminal or civil prosecution. All reports

and statements provided are public records open for public

Gifts of travel may be subject to a $470 gift limit. In

inspection and reproduction.

addition, certain travel payments are reportable gifts, but

are not subject to the gift limit. See the FPPC fact sheet

I f you have any questions regarding this Privacy Notice or

entitled “Limitations and Restrictions on Gifts, Honoraria,

how to access your personal information, please contact

Travel, and Loans,” which can be obtained from the FPPC

the FPPC at:

at

General Counsel

You are not required to disclose:

Fair Political Practices Commission

428 J Street, Suite 620

•

Travel payments received from any state, local, or

Sacramento, CA 95814

federal government agency for which you provided

(916) 322-5660

services equal or greater in value than the payments

received, such as reimbursement for travel on agency

business from your government agency employer.

•

Travel payments received from your employer in the

normal course of your employment.

FPPC Form 700-U (2016/2017)

FPPC Advice Email: advice@fppc.ca.gov

FPPC Toll-Free Helpline: 866/275-3772

1

1 2

2 3

3