Page 3

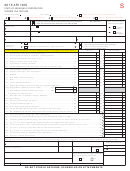

FORM N-35 (REV. 2015)

Name as shown on return

Federal Employer Identification Number

SBF153

b. Attributable

c. Attributable

Schedule K

Shareholders’ Pro Rata Share Items

to Hawaii

Elsewhere

1

1

Ordinary income (loss) from trade or business activities (page 1, line 21)

2

2

Net income (loss) from rental real estate activities (attach federal Form 8825)

3 a Gross income from other rental activities

3a

b Expenses from other rental activities (attach schedule)

3b

c Net income (loss) from other rental activities Line 3a minus line 3b

3c

4

4

Interest income

5

5

Ordinary dividends

6

6

Royalty income

7

7

Net short-term capital gain (loss) (Schedule D (Form N-35))

8

8

Net long-term capital gain (loss) (Schedule D (Form N-35))

9

9

Net gain (loss) under IRC section 1231 (attach Schedule D-1)

10

10

Other income (loss) (attach schedule)

11

11

Charitable contributions (attach schedule)

12

12

IRC section 179 expense deduction (attach federal Form 4562)

13

13

Deductions related to portfolio income (loss) (attach schedule)

14

14

Other deductions (attach schedule)

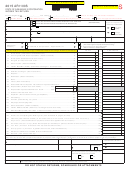

15 a Interest expense on investment debts paid or accrued in 2015

15a

b (1) Investment income included on lines 4, 5, and 6, above

15b(1)

(2) Investment expenses included on line 13, above

15b(2)

16 a Fuel Tax Credit for Commercial Fishers (attach Form N-163)

16a

b Total cost of property qualifying for the Capital Goods Excise Tax Credit (See Instructions)

16b

c Amounts needed to claim the Enterprise Zone Tax Credit (attach Form N-756)

16c

See Instructions

d Hawaii Low-Income Housing Tax Credit (attach Form N-586)

16d

e Credit for Employment of Vocational Rehabilitation Referrals (attach Form N-884)

16e

f Motion Picture, Digital Media, and Film Production Income Tax Credit (attach Form N-340)

16f

g High Technology Business Investment Tax Credit (attach Form N-318)

16g

h Credit for School Repair and Maintenance (attach Form N-330)

16h

i Ethanol Facility Tax Credit (attach Form N-324)

16i

j Renewable Energy Technologies Income Tax Credit (attach Form N-342)

16j

k Important Agricultural Land Qualified Agricultural Cost Tax Credit (attach Form N-344)

16k

l Tax Credit for Research Activities (attach Form N-346)

16l

m Capital Infrastructure Tax Credit (attach Form N-348)

16m

n Hawaii income tax withheld on Forms N-288 (See Instructions)

16n

o Total Hawaii income tax withheld on Forms N-4

16o

p Net income tax paid by the S corporation to states which do not recognize the

16p

corporation’s “S” status Identify state(s)

(Attach a separate schedule if more space is needed for any item.)

17

Total property distributions (including cash) other than dividend distributions

17

reported on line 22, below Date of Distribution __________________________

18

18

Tax exempt interest income

19

19

Other tax exempt income

20

20

Non-deductible expenses

21

Other items and amounts not included on lines 1 through 20, above, that are

21

required to be reported separately to shareholders (attach schedule)

22

22

Total dividend distributions paid from accumulated earnings and profits

23

Income (loss) — Combine lines 1 through 10 From the result, subtract the sum

23

of lines 11 through 15a

24

24

Corporate adjustments to income attributable to Hawaii (attach schedule)

25

25

Interest penalty on early withdrawal of savings

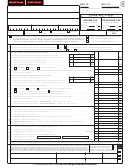

FORM N-35

1

1 2

2 3

3 4

4