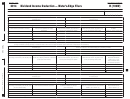

File pg. 8

SOCIAL SECURITY NUMBER

2014 SCHED. B, PAGE 2

0 0

21

Available short-term losses. Combine lines 19 and 20. See instructions . . . . . . . . . . . . . . . . . . . . 21

0 0

22

Short-term losses applied against long-term gains. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23

Short-term losses available for carryover in 2015. Combine lines 21 and 22 and enter result here

0 0

and in line 40, omit lines 24 through 28, and complete Parts 3 and 4 . . . . . . . . . . . . . . . . . . . . . . 23

0 0

24

Short-term gains and long-term gains on collectibles. Enter amount from line 19. See instructions 24

0 0

25

Long-term losses applied against short-term gain. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . 25

0 0

26

Subtotal. Subtract line 25 from line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27

Long-term gains deduction. Complete only if lines 11 and 26 are greater than “0.” If line 11 shows a

0 0

gain, enter 50% of line 11 minus 50% of losses in lines 16, 17, 18 and 25, but not less than “0” . . . 27

0 0

28

Short-term gains after long-term gains deduction. Subtract line 27 from line 26. . . . . . . . . . . . . . . . . 28

PART 3. ADJUSTED GROSS INTEREST, DIVIDENDS, SHORT-TERM CAPITAL GAINS

AND LONG-TERM GAINS ON COLLECTIBLES

0 0

29

Enter the amount from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

0 0

30

Short-term losses applied against interest and dividends. Enter the amount from line 20. . . . . . . . . . . . . . . . . . . . . . 30

0 0

31

Subtotal interest and dividends. Subtract line 30 from line 29. See instructions . . . . . . . . . . . . . . . . . 31

0 0

32

Long-term losses applied against interest and dividends (from worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

0 0

33

Adjusted interest and dividends. Subtract line 32 from line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

0 0

34

Enter the amount from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

PART 4. TAXABLE INTEREST, DIVIDENDS AND CERTAIN CAPITAL GAINS

0 0

35

Adjusted gross interest, dividends and certain capital gains. Add lines 33 and 34 . . . . . . . . . . . . . . 3 35

36

Excess exemptions (from worksheet), only if single, head of household or married filing jointly and Form 1,

0 0

line 18 is greater than Form 1, line 17 or Form 1-NR/PY, line 22 is greater than Form 1-NR/PY, line 21. . . . . . . . 36

0 0

37

Subtract line 36 from line 35. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

38

If line 37 is greater than or equal to line 9, enter the amount from line 9 here and on Form 1, line 20

or Form 1-NR/PY, line 24. If line 37 is less than line 9, enter the amount from line 37 here and on

0 0

Form 1, line 20 or Form 1-NR/PY, line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 38

39

Taxable 12% capital gains. Subtract line 38 from line 37. Not less than “0.” Enter result here and

0 0

on Form 1, line 23a or Form 1-NR/PY, line 27a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 39

40

Available short-term losses for carryover in 2015. Enter amount from line 23. If line 23 was not

0 0

completed, enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

1

1 2

2