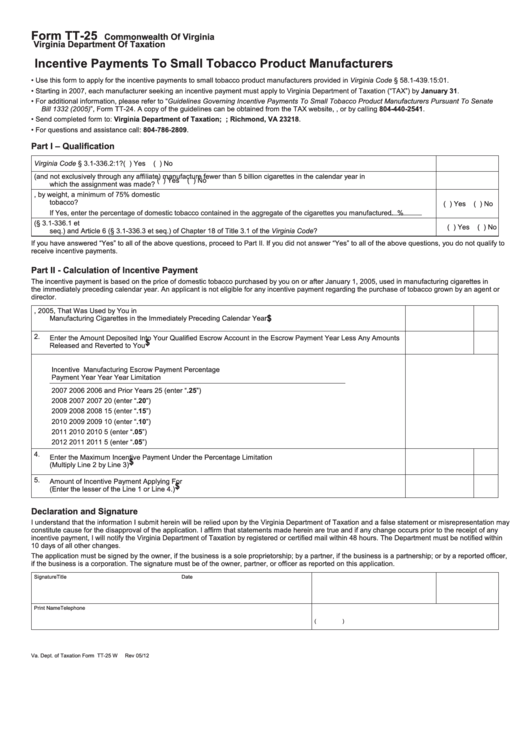

Form TT-25

Commonwealth Of Virginia

Virginia Department Of Taxation

Incentive Payments To Small Tobacco Product Manufacturers

•

Use this form to apply for the incentive payments to small tobacco product manufacturers provided in Virginia Code § 58.1-439.15:01.

•

Starting in 2007, each manufacturer seeking an incentive payment must apply to Virginia Department of Taxation (“TAX”) by January 31.

•

For additional information, please refer to “Guidelines Governing Incentive Payments To Small Tobacco Product Manufacturers Pursuant To Senate

Bill 1332 (2005)”, Form TT-24. A copy of the guidelines can be obtained from the TAX website, , or by calling 804-440-2541.

Send completed form to: Virginia Department of Taxation; P.O. Box 715; Richmond, VA 23218.

•

•

For questions and assistance call: 804-786-2809.

Part I – Qualification

1.

Did you make an escrow assignment to the Commonwealth pursuant to Virginia Code § 3.1-336.2:1?

( ) Yes

( ) No

2.

Did you directly (and not exclusively through any affiliate) manufacture fewer than 5 billion cigarettes in the calendar year in

( ) Yes

( ) No

which the assignment was made?

3.

Did the cigarettes you manufactured during the preceding calendar year contain, by weight, a minimum of 75% domestic

tobacco?

( ) Yes

( ) No

If Yes, enter the percentage of domestic tobacco contained in the aggregate of the cigarettes you manufactured.

%

4.

Are you a Non-Participating Manufacturer in full compliance with all obligations imposed pursuant to Article 5 (§ 3.1-336.1 et

( ) Yes

( ) No

seq.) and Article 6 (§ 3.1-336.3 et seq.) of Chapter 18 of Title 3.1 of the Virginia Code?

If you have answered “Yes” to all of the above questions, proceed to Part II. If you did not answer “Yes” to all of the above questions, you do not qualify to

receive incentive payments.

Part II - Calculation of Incentive Payment

The incentive payment is based on the price of domestic tobacco purchased by you on or after January 1, 2005, used in manufacturing cigarettes in

the immediately preceding calendar year. An applicant is not eligible for any incentive payment regarding the purchase of tobacco grown by an agent or

director.

1.

Enter the Amount Paid for Domestic Tobacco Purchased on or After January 1, 2005, That Was Used by You in

$

Manufacturing Cigarettes in the Immediately Preceding Calendar Year

2.

Enter the Amount Deposited Into Your Qualified Escrow Account in the Escrow Payment Year Less Any Amounts

$

Released and Reverted to You

3.

Enter the Applicable Percentage Limitation - See chart below.

Incentive

Manufacturing

Escrow Payment

Percentage

Payment Year

Year

Year

Limitation

2007

2006

2006 and Prior Years

25 (enter “.25”)

2008

2007

2007

20 (enter “.20”)

2009

2008

2008

15 (enter “.15”)

2010

2009

2009

10 (enter “.10”)

2011

2010

2010

5 (enter “.05”)

2012

2011

2011

5 (enter “.05”)

4.

Enter the Maximum Incentive Payment Under the Percentage Limitation

$

(Multiply Line 2 by Line 3)

5.

Amount of Incentive Payment Applying For

$

(Enter the lesser of the Line 1 or Line 4.)

Declaration and Signature

I understand that the information I submit herein will be relied upon by the Virginia Department of Taxation and a false statement or misrepresentation may

constitute cause for the disapproval of the application. I affirm that statements made herein are true and if any change occurs prior to the receipt of any

incentive payment, I will notify the Virginia Department of Taxation by registered or certified mail within 48 hours. The Department must be notified within

10 days of all other changes.

The application must be signed by the owner, if the business is a sole proprietorship; by a partner, if the business is a partnership; or by a reported officer,

if the business is a corporation. The signature must be of the owner, partner, or officer as reported on this application.

Signature

Title

Date

Print Name

Telephone

(

)

Va. Dept. of Taxation Form TT-25 W

Rev 05/12

1

1