File Form TT-18 and Schedule TT-18-A with the Department of Taxation, P.O. Box 715, Richmond, VA 23218-0715 by the

th

10

of each month. Questions about the form or these instructions can be directed to the NPM Coordinator at the aforementioned

address, or by calling 804-371-0730.

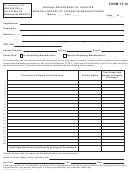

INSTRUCTIONS FOR COMPLETING FORM TT-18

Schedule TT-18 is a report of sales directly into Virginia by manufacturers.

Please complete the report as follows:

HEADING: Provide reporting manufacturer’s complete legal name, Federal ID number and mailing address. Also provide

contact information for a person who can discuss this report during normal business hours.

CHECK the appropriate box to indicate if the report is being filed by a Participating Manufacturer (PM) or a Non-Participating

Manufacturer (NPM).

BODY OF THE FORM: Provide purchaser’s name and address, brand name of cigarettes and total direct sales in Virginia by

brand. Provide a subtotal by brand for each purchaser. Utilize continuation sheet, if necessary.

SIGNATURE: Provide printed name, title and date of completion after signing the form.

INSTRUCTIONS FOR COMPLETING SCHEDULE TT–18-A

Schedule TT-18-A is a summary of monthly cigarette packs sales activity.

HEADING: Provide reporting manufacturer’s complete legal name, Federal ID number and mailing address. Also provide

contact information for a person who can discuss this report during normal business hours.

CHECK the appropriate box to indicate if the report is being filed by a Participating Manufacturer (PM) or a Non-Participating

Manufacturer (NPM).

LINE 1, TOTAL DIRECT VIRGINIA CIGARETTE SALES: Enter the total net number of cigarette packs sold [total sales minus

returns] in Virginia during the month.

LINE 2, ADD INDIRECT VIRGINIA CIGARETTE SALES: Enter the total number of packs sold to non-Virginia wholesalers or

other intermediaries who then resold cigarette packs into Virginia.

LINE 3, LESS INDIRECT CIGARETTE SALES OUT OF VIRGINIA: Enter the total number of packs sold to Virginia wholesalers

or other intermediaries who then resold cigarette packs outside of Virginia.

LINE 4, ADJUSTMENTS: Provide a brief description of any adjustments made to the sales figures on lines 1-3. Indicate if the

adjustment is ADDING or SUBTRACTING from Line 1, Total Net Sales.

LINE 5, TOTAL PACKS SOLD IN VIRGINIA: Enter the result of totaling lines 1-4.

VA FORM TT-18 Instructions - REV 11/05

1

1 2

2 3

3 4

4