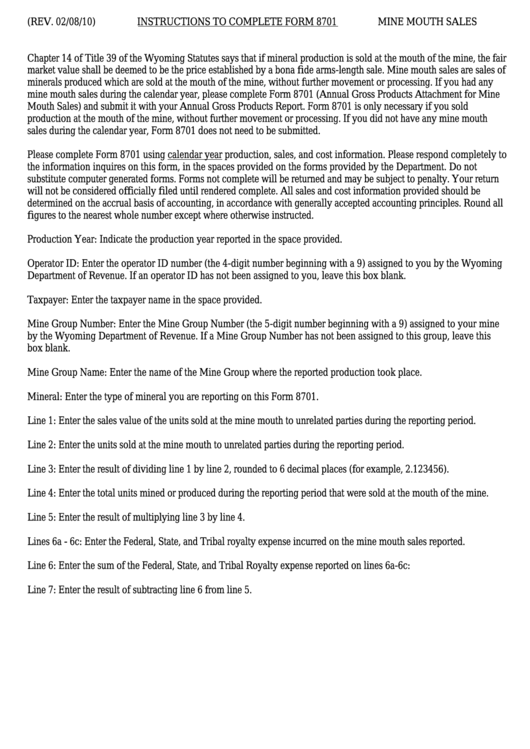

(REV. 02/08/10)

INSTRUCTIONS TO COMPLETE FORM 8701

MINE MOUTH SALES

Chapter 14 of Title 39 of the Wyoming Statutes says that if mineral production is sold at the mouth of the mine, the fair

market value shall be deemed to be the price established by a bona fide arms-length sale. Mine mouth sales are sales of

minerals produced which are sold at the mouth of the mine, without further movement or processing. If you had any

mine mouth sales during the calendar year, please complete Form 8701 (Annual Gross Products Attachment for Mine

Mouth Sales) and submit it with your Annual Gross Products Report. Form 8701 is only necessary if you sold

production at the mouth of the mine, without further movement or processing. If you did not have any mine mouth

sales during the calendar year, Form 8701 does not need to be submitted.

Please complete Form 8701 using calendar year production, sales, and cost information. Please respond completely to

the information inquires on this form, in the spaces provided on the forms provided by the Department. Do not

substitute computer generated forms. Forms not complete will be returned and may be subject to penalty. Your return

will not be considered officially filed until rendered complete. All sales and cost information provided should be

determined on the accrual basis of accounting, in accordance with generally accepted accounting principles. Round all

figures to the nearest whole number except where otherwise instructed.

Production Year: Indicate the production year reported in the space provided.

Operator ID: Enter the operator ID number (the 4-digit number beginning with a 9) assigned to you by the Wyoming

Department of Revenue. If an operator ID has not been assigned to you, leave this box blank.

Taxpayer: Enter the taxpayer name in the space provided.

Mine Group Number: Enter the Mine Group Number (the 5-digit number beginning with a 9) assigned to your mine

by the Wyoming Department of Revenue. If a Mine Group Number has not been assigned to this group, leave this

box blank.

Mine Group Name: Enter the name of the Mine Group where the reported production took place.

Mineral: Enter the type of mineral you are reporting on this Form 8701.

Line 1: Enter the sales value of the units sold at the mine mouth to unrelated parties during the reporting period.

Line 2: Enter the units sold at the mine mouth to unrelated parties during the reporting period.

Line 3: Enter the result of dividing line 1 by line 2, rounded to 6 decimal places (for example, 2.123456).

Line 4: Enter the total units mined or produced during the reporting period that were sold at the mouth of the mine.

Line 5: Enter the result of multiplying line 3 by line 4.

Lines 6a - 6c: Enter the Federal, State, and Tribal royalty expense incurred on the mine mouth sales reported.

Line 6: Enter the sum of the Federal, State, and Tribal Royalty expense reported on lines 6a-6c:

Line 7: Enter the result of subtracting line 6 from line 5.

1

1 2

2