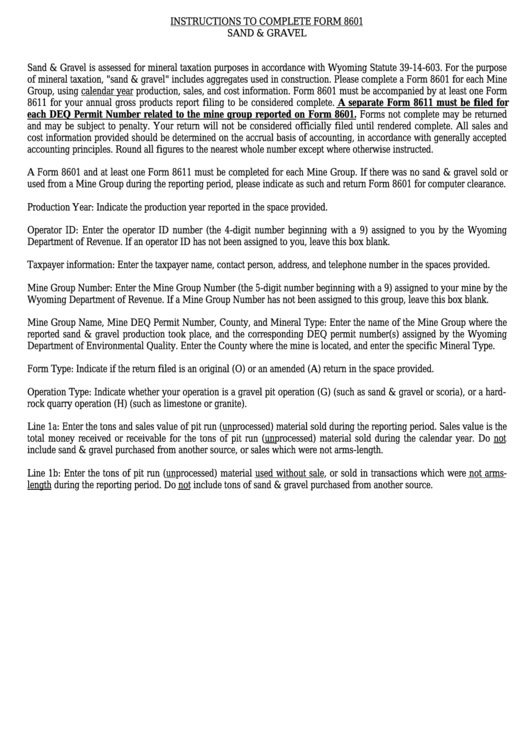

INSTRUCTIONS TO COMPLETE FORM 8601

SAND & GRAVEL

Sand & Gravel is assessed for mineral taxation purposes in accordance with Wyoming Statute 39-14-603. For the purpose

of mineral taxation, "sand & gravel" includes aggregates used in construction. Please complete a Form 8601 for each Mine

Group, using calendar year production, sales, and cost information. Form 8601 must be accompanied by at least one Form

8611 for your annual gross products report filing to be considered complete. A separate Form 8611 must be filed for

each DEQ Permit Number related to the mine group reported on Form 8601. Forms not complete may be returned

and may be subject to penalty. Your return will not be considered officially filed until rendered complete. All sales and

cost information provided should be determined on the accrual basis of accounting, in accordance with generally accepted

accounting principles. Round all figures to the nearest whole number except where otherwise instructed.

A Form 8601 and at least one Form 8611 must be completed for each Mine Group. If there was no sand & gravel sold or

used from a Mine Group during the reporting period, please indicate as such and return Form 8601 for computer clearance.

Production Year: Indicate the production year reported in the space provided.

Operator ID: Enter the operator ID number (the 4-digit number beginning with a 9) assigned to you by the Wyoming

Department of Revenue. If an operator ID has not been assigned to you, leave this box blank.

Taxpayer information: Enter the taxpayer name, contact person, address, and telephone number in the spaces provided.

Mine Group Number: Enter the Mine Group Number (the 5-digit number beginning with a 9) assigned to your mine by the

Wyoming Department of Revenue. If a Mine Group Number has not been assigned to this group, leave this box blank.

Mine Group Name, Mine DEQ Permit Number, County, and Mineral Type: Enter the name of the Mine Group where the

reported sand & gravel production took place, and the corresponding DEQ permit number(s) assigned by the Wyoming

Department of Environmental Quality. Enter the County where the mine is located, and enter the specific Mineral Type.

Form Type: Indicate if the return filed is an original (O) or an amended (A) return in the space provided.

Operation Type: Indicate whether your operation is a gravel pit operation (G) (such as sand & gravel or scoria), or a hard-

rock quarry operation (H) (such as limestone or granite).

Line 1a: Enter the tons and sales value of pit run (unprocessed) material sold during the reporting period. Sales value is the

total money received or receivable for the tons of pit run (unprocessed) material sold during the calendar year. Do not

include sand & gravel purchased from another source, or sales which were not arms-length.

Line 1b: Enter the tons of pit run (unprocessed) material used without sale, or sold in transactions which were not arms-

length during the reporting period. Do not include tons of sand & gravel purchased from another source.

1

1 2

2 3

3 4

4 5

5