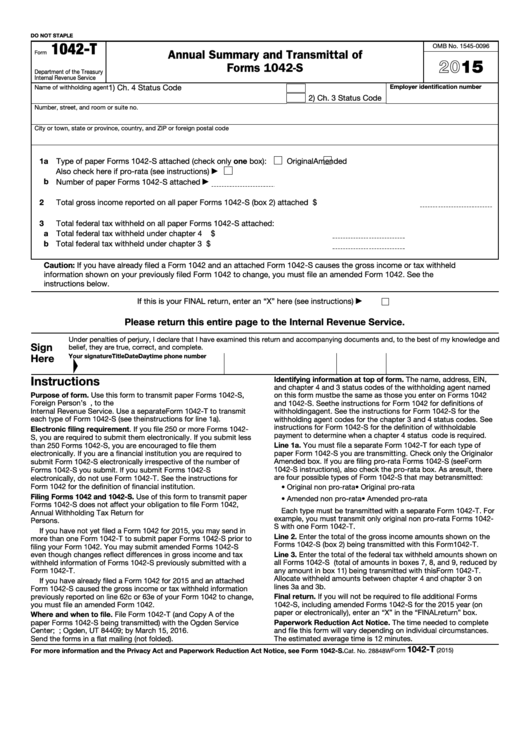

DO NOT STAPLE

1042-T

OMB No. 1545-0096

Annual Summary and Transmittal of

Form

2015

Forms 1042-S

Department of the Treasury

Internal Revenue Service

1) Ch. 4 Status Code

Employer identification number

Name of withholding agent

2) Ch. 3 Status Code

Number, street, and room or suite no.

City or town, state or province, country, and ZIP or foreign postal code

1a Type of paper Forms 1042-S attached (check only one box):

Original

Amended

Also check here if pro-rata (see instructions)

▶

b Number of paper Forms 1042-S attached

▶

2

Total gross income reported on all paper Forms 1042-S (box 2) attached .

.

.

.

.

.

.

.

.

$

3

Total federal tax withheld on all paper Forms 1042-S attached:

a Total federal tax withheld under chapter 4 .

.

.

.

.

.

.

.

.

.

.

$

b Total federal tax withheld under chapter 3 .

.

.

.

.

.

.

.

.

.

.

$

Caution: If you have already filed a Form 1042 and an attached Form 1042-S causes the gross income or tax withheld

information shown on your previously filed Form 1042 to change, you must file an amended Form 1042. See the

instructions below.

If this is your FINAL return, enter an “X” here (see instructions)

▶

Please return this entire page to the Internal Revenue Service.

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and

Sign

belief, they are true, correct, and complete.

Here

Your signature

Title

Date

Daytime phone number

Instructions

Identifying information at top of form. The name, address, EIN,

and chapter 4 and 3 status codes of the withholding agent named

Purpose of form. Use this form to transmit paper Forms 1042-S,

on this form must be the same as those you enter on Forms 1042

Foreign Person’s U.S. Source Income Subject to Withholding, to the

and 1042-S. See the instructions for Form 1042 for definitions of

Internal Revenue Service. Use a separate Form 1042-T to transmit

withholding agent. See the instructions for Form 1042-S for the

each type of Form 1042-S (see the instructions for line 1a).

withholding agent codes for the chapter 3 and 4 status codes. See

instructions for Form 1042-S for the definition of withholdable

Electronic filing requirement. If you file 250 or more Forms 1042-

payment to determine when a chapter 4 status code is required.

S, you are required to submit them electronically. If you submit less

Line 1a. You must file a separate Form 1042-T for each type of

than 250 Forms 1042-S, you are encouraged to file them

paper Form 1042-S you are transmitting. Check only the Original or

electronically. If you are a financial institution you are required to

Amended box. If you are filing pro-rata Forms 1042-S (see Form

submit Form 1042-S electronically irrespective of the number of

1042-S instructions), also check the pro-rata box. As a result, there

Forms 1042-S you submit. If you submit Forms 1042-S

are four possible types of Form 1042-S that may be transmitted:

electronically, do not use Form 1042-T. See the instructions for

Form 1042 for the definition of financial institution.

• Original non pro-rata

• Original pro-rata

Filing Forms 1042 and 1042-S. Use of this form to transmit paper

• Amended non pro-rata

• Amended pro-rata

Forms 1042-S does not affect your obligation to file Form 1042,

Each type must be transmitted with a separate Form 1042-T. For

Annual Withholding Tax Return for U.S. Source Income of Foreign

example, you must transmit only original non pro-rata Forms 1042-

Persons.

S with one Form 1042-T.

If you have not yet filed a Form 1042 for 2015, you may send in

Line 2. Enter the total of the gross income amounts shown on the

more than one Form 1042-T to submit paper Forms 1042-S prior to

Forms 1042-S (box 2) being transmitted with this Form 1042-T.

filing your Form 1042. You may submit amended Forms 1042-S

Line 3. Enter the total of the federal tax withheld amounts shown on

even though changes reflect differences in gross income and tax

all Forms 1042-S (total of amounts in boxes 7, 8, and 9, reduced by

withheld information of Forms 1042-S previously submitted with a

any amount in box 11) being transmitted with this Form 1042-T.

Form 1042-T.

Allocate withheld amounts between chapter 4 and chapter 3 on

If you have already filed a Form 1042 for 2015 and an attached

lines 3a and 3b.

Form 1042-S caused the gross income or tax withheld information

previously reported on line 62c or 63e of your Form 1042 to change,

Final return. If you will not be required to file additional Forms

you must file an amended Form 1042.

1042-S, including amended Forms 1042-S for the 2015 year (on

paper or electronically), enter an “X” in the “FINAL return” box.

Where and when to file. File Form 1042-T (and Copy A of the

paper Forms 1042-S being transmitted) with the Ogden Service

Paperwork Reduction Act Notice. The time needed to complete

Center; P.O. Box 409101; Ogden, UT 84409; by March 15, 2016.

and file this form will vary depending on individual circumstances.

Send the forms in a flat mailing (not folded).

The estimated average time is 12 minutes.

1042-T

For more information and the Privacy Act and Paperwork Reduction Act Notice, see Form 1042-S.

Form

(2015)

Cat. No. 28848W

1

1