Form Reg-3-Mc - Application For Motor Carrier Road Tax - 2013

ADVERTISEMENT

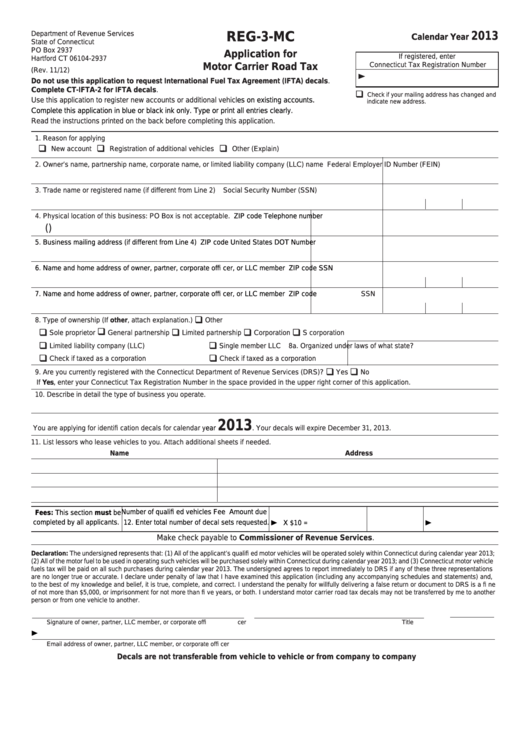

Department of Revenue Services

2013

REG-3-MC

Calendar Year

State of Connecticut

PO Box 2937

Application for

If registered, enter

Hartford CT 06104-2937

Connecticut Tax Registration Number

Motor Carrier Road Tax

(Rev. 11/12)

Do not use this application to request International Fuel Tax Agreement (IFTA) decals.

Complete CT-IFTA-2 for IFTA decals.

Check if your mailing address has changed and

Use this application to register new accounts or additional

vehicles on existing accounts.

indicate new address.

Complete this application in blue or black ink only. Type or print all entries clearly.

Read the instructions printed on the back before completing this application.

1.

Reason for applying

New account

Registration of additional vehicles

Other (Explain)

2.

Owner’s name, partnership name, corporate name, or limited liability company (LLC) name

Federal Employer ID Number (FEIN)

3.

Trade name or registered name (if different from Line 2)

Social Security Number (SSN)

4.

Physical location of this business: PO Box is not acceptable.

ZIP code

Telephone number

(

)

5.

Business mailing address (if different from Line 4)

ZIP code

United States DOT Number

6.

Name and home address of owner, partner, corporate offi cer, or LLC member

ZIP code

SSN

7.

Name and home address of owner, partner, corporate offi cer, or LLC member

ZIP code

SSN

8. Type of ownership (If other, attach explanation.)

Other

Sole proprietor

General partnership

Limited partnership

Corporation

S corporation

Limited liability company (LLC)

Single member LLC

8a. Organized under laws of what state?

Check if taxed as a corporation

Check if taxed as a corporation

9. Are you currently registered with the Connecticut Department of Revenue Services (DRS)?

Yes

No

If Yes, enter your Connecticut Tax Registration Number in the space provided in the upper right corner of this application.

10. Describe in detail the type of business you operate.

2013

You are applying for identifi cation decals for calendar

year

. Your decals will expire December 31, 2013.

11. List lessors who lease vehicles to you. Attach additional sheets if needed.

Name

Address

Number of qualifi ed vehicles

Fee

Amount due

Fees: This section must be

completed by all applicants.

12. Enter total number of decal sets requested.

X $10 =

Make check payable to Commissioner of Revenue Services.

Declaration: The

undersigned

represents that: (1) All of the applicant’s qualifi ed motor vehicles will be operated solely within Connecticut during calendar year 2013;

(2) All of the motor fuel to be used in operating such vehicles will be purchased solely within Connecticut during calendar year 2013; and (3) Connecticut motor vehicle

fuels tax will be paid on all such purchases during calendar year 2013. The undersigned agrees to report immediately to DRS if any of these three representations

are no longer true or accurate. I declare under penalty of law that I have examined this application (including any accompanying schedules and statements) and,

to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne

of not more than $5,000, or imprisonment for not more than fi ve years, or both. I understand motor carrier road tax decals may not be transferred by me to another

person or from one vehicle to another.

Signature of owner, partner, LLC member, or corporate offi cer

Title

Date

Email address of owner, partner, LLC member, or corporate offi cer

Decals are not transferable from vehicle to vehicle or from company to company

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2