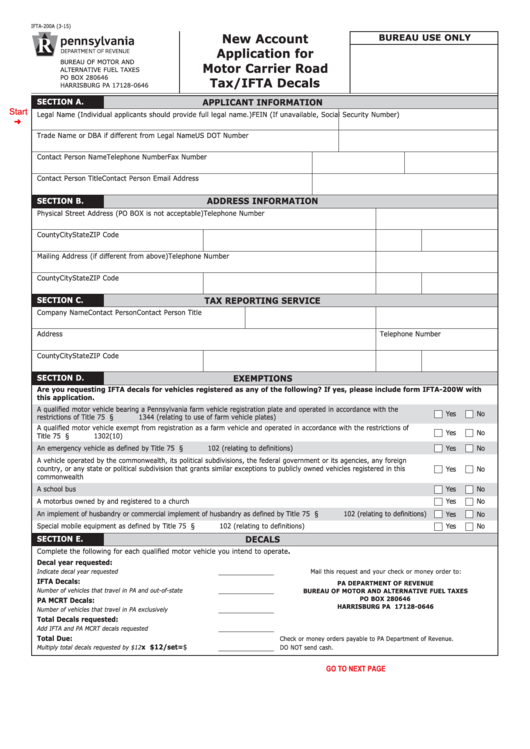

IFTA-200A (3-15)

New Account

BUREAU USE ONLY

Application for

BUREAU OF MOTOR AND

Motor Carrier Road

ALTERNATIVE FUEL TAXES

PO BOX 280646

Tax/IFTA Decals

HARRISBURG PA 17128-0646

SECTION A.

APPLICANT INFORMATION

Start

Legal Name (Individual applicants should provide full legal name.)

FEIN (If unavailable, Social Security Number)

Trade Name or DBA if different from Legal Name

US DOT Number

Contact Person Name

Telephone Number

Fax Number

Contact Person Title

Contact Person Email Address

SECTION B.

ADDRESS INFORMATION

Physical Street Address (PO BOX is not acceptable)

Telephone Number

County

City

State

ZIP Code

Mailing Address (if different from above)

Telephone Number

County

City

State

ZIP Code

SECTION C.

TAX REPORTING SERVICE

Company Name

Contact Person

Contact Person Title

Address

Telephone Number

County

City

State

ZIP Code

SECTION D.

EXEMPTIONS

Are you requesting IFTA decals for vehicles registered as any of the following? If yes, please include form IFTA-200W with

this application.

A qualified motor vehicle bearing a Pennsylvania farm vehicle registration plate and operated in accordance with the

Yes

No

restrictions of Title 75 Pa.C.S. § 1344 (relating to use of farm vehicle plates)

A qualified motor vehicle exempt from registration as a farm vehicle and operated in accordance with the restrictions of

Yes

No

Title 75 Pa.C.S. § 1302(10)

An emergency vehicle as defined by Title 75 Pa.C.S. § 102 (relating to definitions)

Yes

No

A vehicle operated by the commonwealth, its political subdivisions, the federal government or its agencies, any foreign

country, or any state or political subdivision that grants similar exceptions to publicly owned vehicles registered in this

Yes

No

commonwealth

A school bus

Yes

No

A motorbus owned by and registered to a church

Yes

No

An implement of husbandry or commercial implement of husbandry as defined by Title 75 Pa.C.S. § 102 (relating to definitions)

Yes

No

Special mobile equipment as defined by Title 75 Pa.C.S. § 102 (relating to definitions)

Yes

No

SECTION E.

DECALS

Complete the following for each qualified motor vehicle you intend to operate.

Decal year requested:

Indicate decal year requested

Mail this request and your check or money order to:

IFTA Decals:

PA DEPARTMENT OF REVENUE

Number of vehicles that travel in PA and out-of-state

BUREAU OF MOTOR AND ALTERNATIVE FUEL TAXES

PO BOX 280646

PA MCRT Decals:

HARRISBURG PA 17128-0646

Number of vehicles that travel in PA exclusively

Total Decals requested:

Add IFTA and PA MCRT decals requested

Total Due:

Check or money orders payable to PA Department of Revenue.

x $12/set = $

Multiply total decals requested by $12

DO NOT send cash.

Reset Entire Form

GO TO NEXT PAGE

PRINT FORM

1

1 2

2