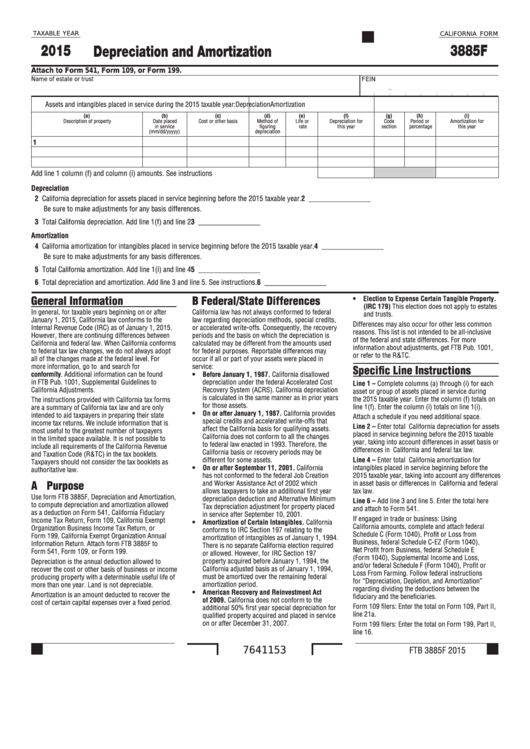

TAXABLE YEAR

CALIFORNIA FORM

2015

3885F

Depreciation and Amortization

Attach to Form 541, Form 109, or Form 199.

Name of estate or trust

FEIN

-

Assets and intangibles placed in service during the 2015 taxable year:

Depreciation

Amortization

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

Description of property

Date placed

Cost or other basis

Method of

Life or

Depreciation for

Code

Period or

Amortization for

in service

figuring

rate

this year

section

percentage

this year

(mm/dd/yyyyy)

depreciation

1

Add line 1 column (f) and column (i) amounts. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation

2 California depreciation for assets placed in service beginning before the 2015 taxable year.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 _________________

Be sure to make adjustments for any basis differences.

3 Total California depreciation. Add line 1(f) and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 _________________

Amortization

4 California amortization for intangibles placed in service beginning before the 2015 taxable year. . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 _________________

Be sure to make adjustments for any basis differences.

5 Total California amortization. Add line 1(i) and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 _________________

6 Total depreciation and amortization. Add line 3 and line 5. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 _________________

General Information

B Federal/State Differences

•

Election to Expense Certain Tangible Property.

(IRC 179) This election does not apply to estates

In general, for taxable years beginning on or after

California law has not always conformed to federal

and trusts.

January 1, 2015, California law conforms to the

law regarding depreciation methods, special credits,

Differences may also occur for other less common

Internal Revenue Code (IRC) as of January 1, 2015.

or accelerated write-offs. Consequently, the recovery

reasons. This list is not intended to be all-inclusive

However, there are continuing differences between

periods and the basis on which the depreciation is

of the federal and state differences. For more

California and federal law. When California conforms

calculated may be different from the amounts used

information about adjustments, get FTB Pub. 1001,

to federal tax law changes, we do not always adopt

for federal purposes. Reportable differences may

or refer to the R&TC.

all of the changes made at the federal level. For

occur if all or part of your assets were placed in

more information, go to ftb.ca.gov and search for

service:

Specific Line Instructions

conformity. Additional information can be found

•

Before January 1, 1987. California disallowed

in FTB Pub. 1001, Supplemental Guidelines to

depreciation under the federal Accelerated Cost

Line 1 – Complete columns (a) through (i) for each

California Adjustments.

Recovery System (ACRS). California depreciation

asset or group of assets placed in service during

is calculated in the same manner as in prior years

the 2015 taxable year. Enter the column (f) totals on

The instructions provided with California tax forms

for those assets.

line 1(f). Enter the column (i) totals on line 1(i).

are a summary of California tax law and are only

•

On or after January 1, 1987. California provides

intended to aid taxpayers in preparing their state

Attach a schedule if you need additional space.

special credits and accelerated write-offs that

income tax returns. We include information that is

Line 2 – Enter total California depreciation for assets

affect the California basis for qualifying assets.

most useful to the greatest number of taxpayers

placed in service beginning before the 2015 taxable

California does not conform to all the changes

in the limited space available. It is not possible to

year, taking into account differences in asset basis or

to federal law enacted in 1993. Therefore, the

include all requirements of the California Revenue

differences in California and federal tax law.

California basis or recovery periods may be

and Taxation Code (R&TC) in the tax booklets.

different for some assets.

Line 4 – Enter total California amortization for

Taxpayers should not consider the tax booklets as

•

On or after September 11, 2001. California

intangibles placed in service beginning before the

authoritative law.

has not conformed to the federal Job Creation

2015 taxable year, taking into account any differences

A Purpose

and Worker Assistance Act of 2002 which

in asset basis or differences in California and federal

tax law.

allows taxpayers to take an additional first year

Use form FTB 3885F, Depreciation and Amortization,

depreciation deduction and Alternative Minimum

Line 6 – Add line 3 and line 5. Enter the total here

to compute depreciation and amortization allowed

Tax depreciation adjustment for property placed

and attach to Form 541.

as a deduction on Form 541, California Fiduciary

in service after September 10, 2001.

If engaged in trade or business: Using

Income Tax Return, Form 109, California Exempt

•

Amortization of Certain Intangibles. California

California amounts, complete and attach federal

Organization Business Income Tax Return, or

conforms to IRC Section 197 relating to the

Schedule C (Form 1040), Profit or Loss from

Form 199, California Exempt Organization Annual

amortization of intangibles as of January 1, 1994.

Business, federal Schedule C-EZ (Form 1040),

Information Return. Attach form FTB 3885F to

There is no separate California election required

Net Profit from Business, federal Schedule E

Form 541, Form 109, or Form 199.

or allowed. However, for IRC Section 197

(Form 1040), Supplemental Income and Loss,

property acquired before January 1, 1994, the

Depreciation is the annual deduction allowed to

and/or federal Schedule F (Form 1040), Profit or

California adjusted basis as of January 1, 1994,

recover the cost or other basis of business or income

Loss From Farming. Follow federal instructions

must be amortized over the remaining federal

producing property with a determinable useful life of

for “Depreciation, Depletion, and Amortization”

amortization period.

more than one year. Land is not depreciable.

regarding dividing the deductions between the

•

American Recovery and Reinvestment Act

Amortization is an amount deducted to recover the

fiduciary and the beneficiaries.

of 2009. California does not conform to the

cost of certain capital expenses over a fixed period.

Form 109 filers: Enter the total on Form 109, Part II,

additional 50% first year special depreciation for

line 21a.

qualified property acquired and placed in service

on or after December 31, 2007.

Form 199 filers: Enter the total on Form 199, Part II,

line 16.

FTB 3885F 2015

7641153

1

1