Form 41es - Estimated Tax Payment/extension Of Time Payment Idaho Business Income Tax

ADVERTISEMENT

EFO00026

08-26-09

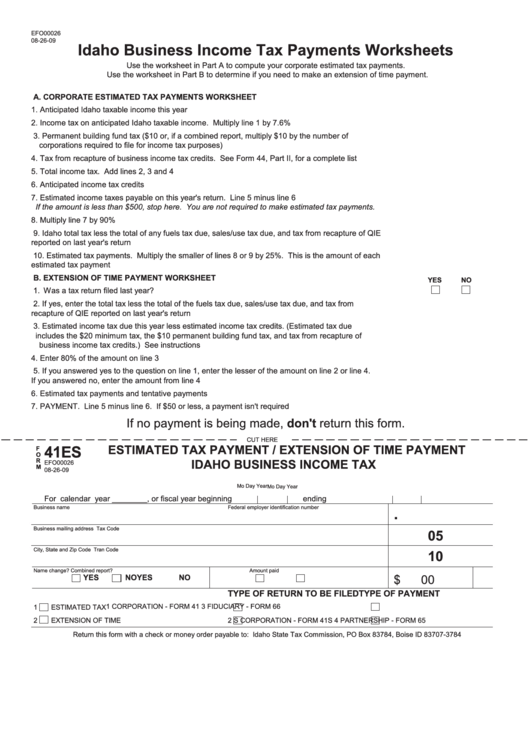

idaho Business income tax payments Worksheets

Use the worksheet in Part A to compute your corporate estimated tax payments.

Use the worksheet in Part B to determine if you need to make an extension of time payment.

A. CorporAte estimAted tAx pAyments Worksheet

1. Anticipated Idaho taxable income this year ......................................................................................... 1. ____________________

2. Income tax on anticipated Idaho taxable income. Multiply line 1 by 7.6% .......................................... 2. ____________________

3. Permanent building fund tax ($10 or, if a combined report, multiply $10 by the number of

corporations required to file for income tax purposes) ......................................................................... 3. ____________________

4. Tax from recapture of business income tax credits. See Form 44, Part II, for a complete list ............ 4. ____________________

5. Total income tax. Add lines 2, 3 and 4 ................................................................................................ 5. ____________________

6. Anticipated income tax credits ............................................................................................................. 6. ____________________

7. Estimated income taxes payable on this year's return. Line 5 minus line 6 ........................................ 7. ____________________

If the amount is less than $500, stop here. You are not required to make estimated tax payments.

8. Multiply line 7 by 90% .......................................................................................................................... 8. ____________________

9. Idaho total tax less the total of any fuels tax due, sales/use tax due, and tax from recapture of QIE

reported on last year's return ............................................................................................................... 9. ____________________

10. Estimated tax payments. Multiply the smaller of lines 8 or 9 by 25%. This is the amount of each

estimated tax payment ......................................................................................................................... 10. ____________________

B. extension of time pAyment Worksheet

yes

no

1. Was a tax return filed last year? ........................................................................................................... 1.

2. If yes, enter the total tax less the total of the fuels tax due, sales/use tax due, and tax from

recapture of QIE reported on last year's return .................................................................................... 2. ____________________

3. Estimated income tax due this year less estimated income tax credits. (Estimated tax due

includes the $20 minimum tax, the $10 permanent building fund tax, and tax from recapture of

business income tax credits.) See instructions ................................................................................... 3. ____________________

4. Enter 80% of the amount on line 3 ....................................................................................................... 4. ____________________

5. If you answered yes to the question on line 1, enter the lesser of the amount on line 2 or line 4.

If you answered no, enter the amount from line 4 ................................................................................ 5. ____________________

6. Estimated tax payments and tentative payments ................................................................................ 6. ____________________

7. PAYMENT. Line 5 minus line 6. If $50 or less, a payment isn't required ............................................ 7. ____________________

If no payment is being made, don't return this form.

CUT HERE

41es

estimAted tAx pAyment / extension of time pAyment

f

o

idAho BUsiness inCome tAx

r

EFO00026

m

08-26-09

Mo

Day

Year

Mo

Day

Year

For calendar year ________, or fiscal year beginning

ending

.

Business name

Federal employer identification number

Business mailing address

Tax Code

05

City, State and Zip Code

Tran Code

10

Name change?

Combined report?

Amount paid

$

00

yes

no

yes

no

type of pAyment

type of retUrn to Be fiLed

1

CORPORATION - FORM 41

3

FIDUCIARY - FORM 66

1

ESTIMATED TAX

2

EXTENSION OF TIME

2

S CORPORATION - FORM 41S

4

PARTNERSHIP - FORM 65

Return this form with a check or money order payable to: Idaho State Tax Commission, PO Box 83784, Boise ID 83707-3784

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1