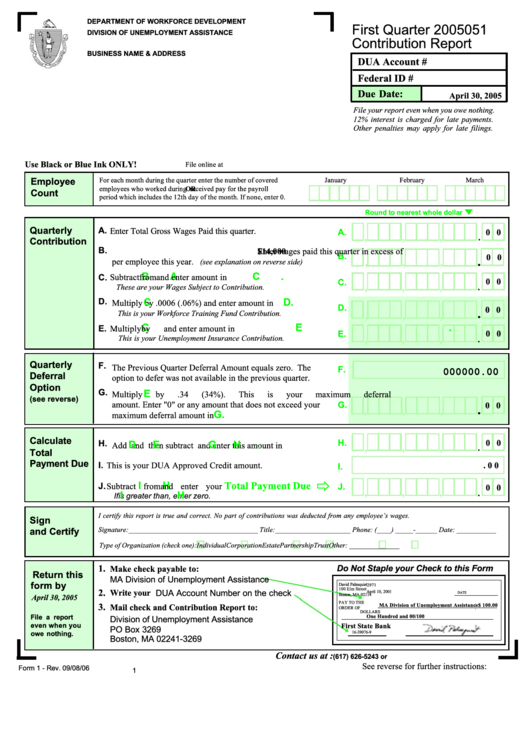

DEPARTMENT OF WORKFORCE DEVELOPMENT

First Quarter 2005

051

DIVISION OF UNEMPLOYMENT ASSISTANCE

Contribution Report

BUSINESS NAME & ADDRESS

DUA Account #

Federal ID #

Due Date:

April 30, 2005

File your report even when you owe nothing.

12% interest is charged for late payments.

Other penalties may apply for late filings.

Use Black or Blue Ink ONLY!

File online at https://wfb.dor.state.ma.us/Webfile

For each month during the quarter enter the number of covered

January

February

March

Employee

employees who worked during

OR

received pay for the payroll

Count

period which includes the 12th day of the month. If none, enter 0.

Round to nearest whole dollar

Quarterly

A.

Enter Total Gross Wages Paid this quarter.

A.

0 0

,

,

,

Contribution

B.

Enter wages paid this quarter in excess of

$14,000

B.

0 0

,

,

,

.

per employee this year.

(see explanation on reverse side)

B

A

C.

C.

Subtract

from

and enter amount in

C.

0 0

,

,

,

These are your Wages Subject to Contribution.

D.

C

D.

Multiply

by .0006 (.06%) and enter amount in

D.

0 0

,

,

,

.

This is your Workforce Training Fund Contribution.

C

E.

E.

.

Multiply

by

and enter amount in

E.

0 0

,

,

,

This is your Unemployment Insurance Contribution.

Quarterly

F.

The Previous Quarter Deferral Amount equals zero. The

000000.00

F.

Deferral

option to defer was not available in the previous quarter.

Option

G.

E

Multiply

by .34 (34%). This is your maximum deferral

(see reverse)

G.

amount. Enter "0" or any amount that does not exceed your

0 0

,

,

,

.

G.

maximum deferral amount in

Calculate

H.

0 0

H.

D

E

G

H.

,

,

,

Add

and

then subtract

and enter this amount in

Total

Payment Due

I.

This is your DUA Approved Credit amount.

. 0 0

I.

ð

I

H

J.

Total Payment Due

Subtract from

and enter your

J.

0 0

,

,

,

If is greater than

I

H

, enter zero.

I certify this report is true and correct. No part of contributions was deducted from any employee’s wages.

Sign

Signature:____________________________________ Title:_____________________ Phone: (____) _____-______ Date: ___________

and Certify

Type of Organization (check one):

Individual

Corporation

Estate

Partnership

Trust

Other: ______________

Do Not Staple your Check to this Form

1.

Make check payable to:

Return this

MA Division of Unemployment Assistance

form by

David Palmquist

2971

100 Elm Street

2.

DUA Account Number on the check

Write your

April 10, 2001

DATE

April 30, 2005

Boston, MA 02114

PAY TO THE

MA Division of Unemployment Assistance $ 100.00

3.

Mail check and Contribution Report to:

ORDER OF

DOLLARS

One Hundred and 00/100

File a report

Division of Unemployment Assistance

even when you

First State Bank

PO Box 3269

16-39076-9

owe nothing.

Boston, MA 02241-3269

Contact us at :

(617) 626-5243 or

Form 1 - Rev. 09/08/06

See reverse for further instructions:

1

1

1 2

2 3

3 4

4