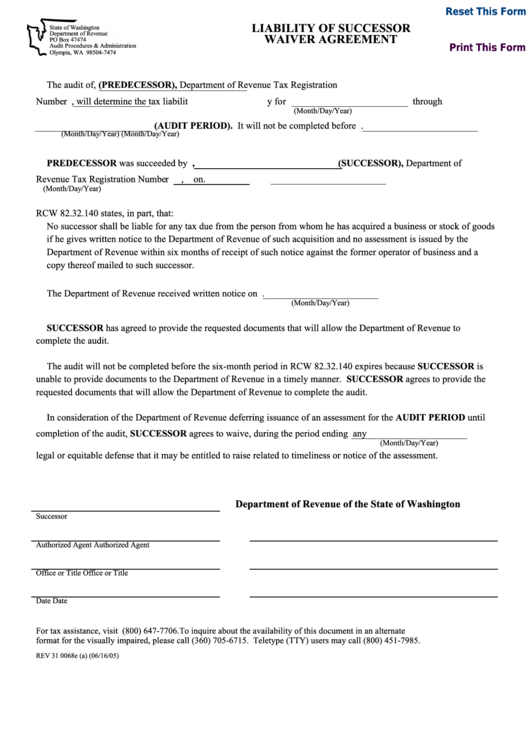

Reset This Form

LIABILITY OF SUCCESSOR

State of Washington

Department of Revenue

WAIVER AGREEMENT

PO Box 47474

Audit Procedures & Administration

Print This Form

Olympia, WA 98504-7474

The audit of

, (PREDECESSOR), Department of Revenue Tax Registration

Number

, will determine the tax liability for

through

(Month/Day/Year)

(AUDIT PERIOD). It will not be completed before

.

(Month/Day/Year)

(Month/Day/Year)

PREDECESSOR was succeeded by

, (SUCCESSOR), Department of

Revenue Tax Registration Number

, on

.

(Month/Day/Year)

RCW 82.32.140 states, in part, that:

No successor shall be liable for any tax due from the person from whom he has acquired a business or stock of goods

if he gives written notice to the Department of Revenue of such acquisition and no assessment is issued by the

Department of Revenue within six months of receipt of such notice against the former operator of business and a

copy thereof mailed to such successor.

The Department of Revenue received written notice on

.

(Month/Day/Year)

SUCCESSOR has agreed to provide the requested documents that will allow the Department of Revenue to

complete the audit.

The audit will not be completed before the six-month period in RCW 82.32.140 expires because SUCCESSOR is

unable to provide documents to the Department of Revenue in a timely manner. SUCCESSOR agrees to provide the

requested documents that will allow the Department of Revenue to complete the audit.

In consideration of the Department of Revenue deferring issuance of an assessment for the AUDIT PERIOD until

completion of the audit, SUCCESSOR agrees to waive, during the period ending

any

(Month/Day/Year)

legal or equitable defense that it may be entitled to raise related to timeliness or notice of the assessment.

Department of Revenue of the State of Washington

Successor

Authorized Agent

Authorized Agent

Office or Title

Office or Title

Date

Date

For tax assistance, visit or call (800) 647-7706. To inquire about the availability of this document in an alternate

format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call (800) 451-7985.

REV 31 0068e (a) (06/16/05)

1

1