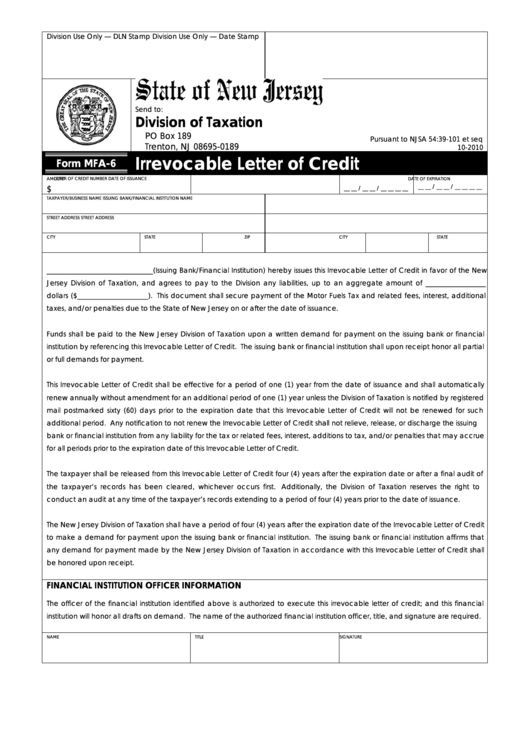

Division Use Only — DLN Stamp

Division Use Only — Date Stamp

Send to:

Division of Taxation

PO Box 189

Pursuant to NJSA 54:39-101 et seq

Trenton, NJ 08695-0189

10-2010

Irrevocable Letter of Credit

Form MFA-6

AMOUNT

LETTER OF CREDIT NUMBER

DATE OF ISSUANCE

DATE OF EXPIRATION

$

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

TAXPAYER/BUSINESS NAME

ISSUING BANK/FINANCIAL INSTITUTION NAME

STREET ADDRESS

STREET ADDRESS

CITY

STATE

ZIP

CITY

STATE

ZIP

______________________________(Issuing Bank/Financial Institution) hereby issues this Irrevocable Letter of Credit in favor of the New

Jersey Division of Taxation, and agrees to pay to the Division any liabilities, up to an aggregate amount of _________________

dollars ($____________________). This document shall secure payment of the Motor Fuels Tax and related fees, interest, additional

taxes, and/or penalties due to the State of New Jersey on or after the date of issuance.

Funds shall be paid to the New Jersey Division of Taxation upon a written demand for payment on the issuing bank or financial

institution by referencing this Irrevocable Letter of Credit. The issuing bank or financial institution shall upon receipt honor all partial

or full demands for payment.

This Irrevocable Letter of Credit shall be effective for a period of one (1) year from the date of issuance and shall automatically

renew annually without amendment for an additional period of one (1) year unless the Division of Taxation is notified by registered

mail postmarked sixty (60) days prior to the expiration date that this Irrevocable Letter of Credit will not be renewed for such

additional period. Any notification to not renew the Irrevocable Letter of Credit shall not relieve, release, or discharge the issuing

bank or financial institution from any liability for the tax or related fees, interest, additions to tax, and/or penalties that may accrue

for all periods prior to the expiration date of this Irrevocable Letter of Credit.

The taxpayer shall be released from this Irrevocable Letter of Credit four (4) years after the expiration date or after a final audit of

the taxpayer’s records has been cleared, whichever occurs first. Additionally, the Division of Taxation reserves the right to

conduct an audit at any time of the taxpayer’s records extending to a period of four (4) years prior to the date of issuance.

The New Jersey Division of Taxation shall have a period of four (4) years after the expiration date of the Irrevocable Letter of Credit

to make a demand for payment upon the issuing bank or financial institution. The issuing bank or financial institution affirms that

any demand for payment made by the New Jersey Division of Taxation in accordance with this Irrevocable Letter of Credit shall

be honored upon receipt.

FINANCIAL INSTITUTION OFFICER INFORMATION

The officer of the financial institution identified above is authorized to execute this irrevocable letter of credit; and this financial

institution will honor all drafts on demand. The name of the authorized financial institution officer, title, and signature are required.

NAME

TITLE

SIGNATURE

1

1