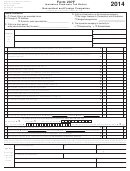

Property Tax Form 82050 - Electric Generation Companies - 2014 Page 9

ADVERTISEMENT

BY SIGNING THE VERIFICATION PAGE, THE TAXPAYER WAIVES ALL CONFIDENTIALITY REQUIREMENTS OF A.R.S.

42-2001 THROUGH 42-2004 WITH RESPECT TO THIS PAGE AND

CONSENTS TO THE DISCLOSURE OF THE CONTENTS OF THIS PAGE TO COUNTY ASSESSOR PERSONNEL BY THE ARIZONA DEPARTMENT OF REVENUE.

ARIZONA DEPARTMENT OF REVENUE PROPERTY TAX FORM

ELECTRIC GENERATION COMPANIES

TAX YEAR 2014

Company Name:

CVP Taxpayer ID:

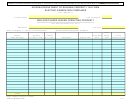

NON-CAPITALIZED LEASED OPERATING PROPERTY

Year Ending December 31, 2012

Plant Name:

Fuel Type:

*Note: B = Buildings, L = Land, PP = Personal Property

(Exclude Licensed Transportation Equipment)

Lease

Lessor's

(Property

Indicate

Lease Start

Ending

Annual

Name & Address

Location) County

B, L, or PP*

Description

Original Cost

Date

Date

Lease Payment

Totals

-

-

Attach additional pages as needed.

DOR Form 82050 (Rev 12/12)

1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14