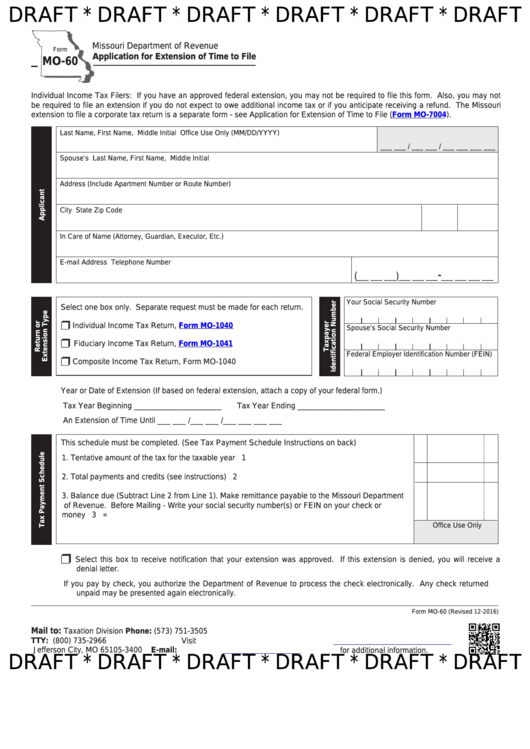

Form Mo-60 Draft - Application For Extension Of Time To File

ADVERTISEMENT

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

Missouri Department of Revenue

Form

Application for Extension of Time to File

MO-60

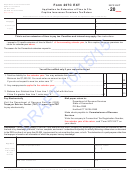

Individual Income Tax Filers: If you have an approved federal extension, you may not be required to file this form. Also, you may not

be required to file an extension if you do not expect to owe additional income tax or if you anticipate receiving a refund. The Missouri

extension to file a corporate tax return is a separate form - see Application for Extension of Time to File

(Form

MO-7004).

Last Name, First Name, Middle Initial

Office Use Only (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Spouse’s Last Name, First Name, Middle Initial

Address (Include Apartment Number or Route Number)

City

State

Zip Code

In Care of Name (Attorney, Guardian, Executor, Etc.)

E-mail Address

Telephone Number

-

(

)

___ ___ ___

___ ___ ___

___ ___ ___ ___

Your Social Security Number

Select one box only. Separate request must be made for each return.

r

Individual Income Tax Return,

Form MO-1040

Spouse’s Social Security Number

r

Fiduciary Income Tax Return,

Form MO-1041

Federal Employer Identification Number (FEIN)

r

Composite Income Tax Return, Form MO-1040

Year or Date of Extension (If based on federal extension, attach a copy of your federal form.)

Tax Year Beginning ____________________

Tax Year Ending ____________________

An Extension of Time Until ___ ___ /___ ___ /___ ___ ___ ___

This schedule must be completed. (See Tax Payment Schedule Instructions on back)

1. Tentative amount of the tax for the taxable year ................................................................................ 1

2. Total payments and credits (see instructions) .................................................................................... 2

3. Balance due (Subtract Line 2 from Line 1). Make remittance payable to the Missouri Department

of Revenue. Before Mailing - Write your social security number(s) or FEIN on your check or

money order........................................................................................................................................ 3

=

Office Use Only

r

Select this box to receive notification that your extension was approved. If this extension is denied, you will receive a

denial letter.

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned

unpaid may be presented again electronically.

Form MO-60 (Revised 12-2016)

Mail to:

Taxation Division

Phone: (573) 751-3505

P.O. Box 3400

TTY: (800) 735-2966

Visit

dor.mo.gov/personal/individual/

Jefferson City, MO 65105-3400

E-mail:

income@dor.mo.gov

for additional information.

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2