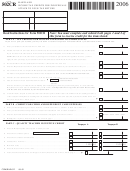

MARYLAND INCOME TAX

FORM

Page 4

502CR

CREDITS FOR INDIVIDUALS

INSTRUCTIONS

2012

PART G - INCOME TAX CREDIT SUMMARY

This part is to summarize Parts A through F and the non-

refundable portion of Heritage Structure Rehabilitation tax

credits . If the total from Part G, line 8 exceeds the state tax, the

excess may not be refunded .

PART H - REFUNDABLE INCOME TAX CREDITS

Line 1 NEIGHBORHOOD STABILIZATION CREDIT

If you live in the Waverly or Landsdowne sections

of Baltimore City, or in the Hillendale, Northbrook,

Pelham Woods, or Taylor/Dartmouth areas of Baltimore

County, you may qualify for this credit . Credit for homes

purchased in Baltimore City must have been applied

for by December 31, 2002 . Credit for homes purchased

in Baltimore County must have been applied for by

December 31, 2005. After certification by Baltimore City

or Baltimore County, you may claim an income tax credit

equal to the property tax credit granted by Baltimore City

or Baltimore County . Enter the amount on line 1 of Part H

and attach a copy of the certification.

Line 2 HERITAGE

STRUCTURE

REHABILITATION

TAX

CREDIT AND SUSTAINABLE COMMUNITIES TAX

CREDIT

See instructions for Form 502H and Form 502S .

Line 3 REFUNDABLE BUSINESS INCOME TAX CREDIT

See Form 500CR for qualifications and instructions for

the One Maryland Economic Development Tax Credit,

the Biotechnology Investment Incentive Tax Credit, Job

Creation and Recovery Tax Credit, the Clean Energy

Incentive Tax Credit and Film Production Employment

Tax Credit .

Line 4 IRC SECTION 1341 REPAYMENT CREDIT

If you repaid an amount reported as income on a prior

year tax return this year that was greater than $3,000,

you may be eligible for an IRC Section 1341 Repayment

credit . Attach documentation . For additional information,

see Administrative Release 40 .

Line 5 FLOW-THROUGH NONRESIDENT PTE TAX

If you are the beneficiary of a Trust or a Qualified

Subchapter S Trust for which nonresident PTE tax was

paid, you may be entitled to a credit for your share of

that tax . Enter the amount on this line and attach both

the Form 1041 Schedule K-1 for the trust (or Form 504

Schedule K-1) and a copy of the K-1 issued to the trust

by the PTE .

If you are a member of a PTE for which nonresident tax

was paid, you may be entitled to a credit for your share

of that tax . Enter the amount on this line and attach

the federal Schedule K-1 and Form 510 Schedule K-1(or

a Form 510 Schedule K-1 equivalent statement) issued

to you and to the partnership, limited liability company,

or S Corporation, by the PTE .

Line 6 Add lines 1 through 5 and enter the total on the

appropriate line of the income tax form being filed.

COM/RAD-012

12-49

1

1 2

2 3

3 4

4 5

5 6

6