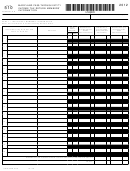

MARYLANd

2012

FORM

510

PASS-THROUGH ENTITY

INCOME TAX RETURN INSTRUCTIONS

Form 510.

flow limitation will not reduce the

the result. The total amount due must be

tax liability of the nonresident

paid with Form 510.

Partnerships, however, such as brokerage

members.

firms that deal with the general public,

Continue to Line 20 only when there

are not exempt if the business is

If the distributable cash flow limitation is

are no nonresident members (lines 1b

conducted within Maryland and should

used, check the box and enter the result

and 1c are both zero).

complete lines 5-19. See Administrative

on line 14. If less than zero, enter zero.

L i n e

2 0

-

A m o u n t

t o

b e

Release 6.

If the distributable cash flow limitation is

Refunded Enter the amount from line

not used, do not complete this line.

Line 5 - Percentage of ownership by

16d if the amount on line 13 is zero.

nonresident individual members Enter

Line 15 - Nonresident tax due If the

NOTE: Overpayments will not be

the total percentage of ownership by

distributable cash flow limitation is not

refunded to any PTE that has any

nonresident individual members. If the

used, enter the amount shown on line

members

that

are

nonresident

profit/loss allocation is different from the

13. If the distributable cash flow method

individuals or nonresident entities.

ownership percentage, use the profit/loss

is used, enter the lesser of line 13 or line

allocation to complete this line. If 100%

14.

Signature

and

Verification

An

leave blank.

authorized general partner, officer or

Line 16 - Payments and Credits

member of the PTE must sign and date

Line 6 - distributive or pro rata share

16a. Enter the total of amounts paid

Form 510 and enter his or her title. If a

of income for nonresident individual

during the tax year with Form 510D

preparer is used, the preparer must also

members

Multiply line 4 by the

- Maryland Pass-Through Entity

sign the return and enter the firm name,

percentage on line 5 and enter the result.

Declaration of Estimated Income

address and Preparer's Tax Identification

If line 5 is blank because the percentage

Tax. Also include amounts paid by

Number (PTIN). Penalties may be

of ownership equals 100%, enter the

the PTE using Form MW506NRS -

imposed for tax preparers who fail to

amount from line 4.

Return of Income Tax Withheld For

sign the tax return and provide their

Line 7 - Nonresident individual

Nonresident Sale of Real Property.

PTIN.

tax

Multiply the amount on line 6 by

16b. Enter the amount paid with Form

M a i l i n g

I n s t r u c t i o n s

M a i l

t h e

5.75%.

510E - Maryland Application for

completed return and all required

Lin e

8

-

S pec ial

n on residen t

Extension to File Pass-Through

attachments to: Comptroller of Maryland,

tax

Multiply the amount on line 6 by

Entity Income Tax Return.

Revenue Administration Division, 110

1.25%. All nonresident individuals are

Carroll Street, Annapolis, MD 21411-

16c. Enter the amount of nonresident

liable for an additional state tax on

0001

tax paid on the PTE’s behalf by

income allocable to Maryland calculated

another PTE. Attach the Maryland

at the lowest local income tax rate in

Schedule K-1 or statement supplied

place for the tax year.

by the other PTE to support this

Line 9 - Total Maryland tax on

credit.

individual members Add lines 7 and

16d. Total payments and credits.

8.

Enter the sum of lines 16a through

Line 10 - Percentage of ownership by

16c.

nonresident entity members Enter the

Line 17 - Balance of Tax due Enter

total percentage of ownership by

the difference if line 15 exceeds 16d.

nonresident entity members. If the

profit/loss allocation is different from the

Line 18 - Interest and/or Penalty

ownership percentage, use the profit/loss

Calculate the amount of interest and/or

allocation to complete this line. If 100%

penalty

due

as

a

result

of

the

leave blank.

underpayment of estimated tax. Use

Line 11 - distributive or pro rata

Form 500UP.

share of income

for nonresident

Partnerships and LLCs with income

entity members Multiply line 4 by the

received unevenly throughout the year,

percentage on line 10 and enter the

and that choose to annualize on Form

result. If line 10 is blank because the

500UP, must enter 301 in one of the

percentage of ownership equals 100%,

code number boxes at the bottom of

enter the amount from line 4.

page 1, Form 510. S corporations may

Line

12

-

Nonresident

entity

not use the annualization method on

tax Multiply the amount on line 11 by

Form

500UP,

available

at

www.

8.25%.

Line 13 - Total nonresident tax Add

If Form 510 is filed late, calculate interest

lines 9 and 12.

on the amount of tax that was not paid

by the original due date. Interest is due

Line 14 - distributable cash flow

at an annual rate of 13% or 1.08% per

limitation

PTEs may elect to use the

month or part of a month that tax is paid

distributable cash flow method to limit

after the due date of the return.

the nonresident tax which must be paid

by the PTE. If the distributable cash flow

A penalty may be imposed if any tax is

is less than the nonresident tax, the

not paid when due. Any penalty due will

required payment is limited to the

be calculated and assessed after filing of

amount determined by the distributable

Form 510.

cash flow method.

Line 19 - Total Balance due Add the

Election of the distributable cash

amounts on lines 17 and 18 and enter

4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13