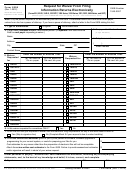

Instructions for Form 2357,

Waiver of the Michigan Estate Tax Lien

The Michigan estate tax is a lien on the gross estate until the tax

If a payment is required, complete the Michigan Estate Tax

is paid in full. If real estate is being transferred before the tax is

Estimate Voucher (Form 2527). Send the payment, the estimate

paid, a waiver of the Michigan estate tax lien must be requested.

voucher and this waiver request to:

Estate Tax Section

Complete the front of this form. Enter the reason code from the

list below on line 10. Attach copies of required documents to this

Michigan Department of Treasury

form.

Lansing, MI 48922

Reason

Reason

Code

Code

1

Part of the real estate must be sold to pay claims

5

The real property was sold after the due date of the

against the estate or administration expenses. This

return, including extensions, and a payment is en-

waiver may be honored even if other assets are

closed with this waiver request for the lesser of:

available. Send an itemized list of the debts of the

• 16 percent of the net cash proceeds (complete

decedent and expenses which will be paid from the

the worksheet below), or

proceeds of the estate.

• the amount of tax shown due on the return.

2

No tax liability exists, or the liability has been fully

discharged or provided for. Send a copy of a finan-

If you use this reason code, include a copy of the

cial statement of all probate and non-probate assets

purchase agreement.

and liabilities.

6

An estimated payment equal to the estate tax due is

3

A lien has been recorded with the county where the

enclosed. Send a detailed schedule showing the

property is located and the full amount of the lien has

value of the estate and the estimated tax due.

been paid or is enclosed.

7

An estimated payment equal to the tax shown on the

4

The real property was sold before the due date of

enclosed probate court order is enclosed.

the estate tax return, including extensions. Pay-

ment equal to 8 percent of net cash proceeds is

8

The seller or mortgagor is a surviving joint tenant or

enclosed. Complete the Net Cash Proceeds

tenant by the entireties. Send a copy of the deed or

Worksheet below. If you use this reason code,

other legal document showing ownership.

include a copy of the purchase agreement.

Net Cash Proceeds WORKSHEET

If you are requesting a waiver based on reason code 4 or 5, complete this worksheet and include it with your request.

1. Gross sales price (including land contracts accepted as part of sales proceeds)............ 1.

.00

TOTAL EXPENSES TO BE PAID BY THE SELLER OR MORTGAGOR

2. Sales commissions ............................................................... 2.

.00

3. Encumbrances and liens at the date of death, including

interest to the date of closing. ............................................... 3.

.00

4. Transfer taxes ....................................................................... 4.

.00

5. Title insurance premiums and fees paid to the

title insurance company ....................................................... 5.

.00

6. Total expenses. Add lines 2 through 5. .......................................................................... 6.

.00

7. Net cash proceeds. Subtract line 6 from line 1. ................................................................ 7.

.00

1

1 2

2