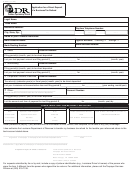

Direct Deposit of Maryland Income

FORM

588

Tax Refund to More Than One

2012

Account Instructions

Ask your financial institution for the correct routing number to

amount of your refund is increased, the additional amount will be

use.

deposited to the last account on line 2 or 3 as applicable.

Lines 1c, 2c, and 3c

Example. Your return shows a refund of $300 and you ask that

the refund be split among three accounts with $100 in each

Be sure to check only one box for the account type to ensure your

account. Due to an error on the return, your refund is increased

deposit will be accepted. If you are not sure, ask your financial

to $350. The additional $50 will be added to the deposit to the

institution whether you should check the “Checking” or “Savings”

account on line 3.

box.

Refund decreased. If you made an error on your return and the

Lines 1d, 2d, and 3d

amount of your refund is decreased, the reduced amount will be

The account number can be up to 17 characters (both numbers

taken from the accounts on line 3, 2 and 1, in that order and as

and letters). Omit spaces, hyphens, and special symbols. Enter

applicable.

the number from left to right and leave any unused line blank.

Example. Your return shows a refund of $300 and you ask that

On the sample check below, the account number is 00202086. Do

the refund be split among three accounts with $100 in each

not include the check number.

account. Due to an error on your return, your refund is decreased

Line 4

by $150. You will not receive the $100 you asked us to deposit

to the account on line 3 and the deposit to the account on line 2

The total on line 4 must equal the total amount of your refund

will be reduced by $50.

as shown on your tax return. If the total on line 4 is different, a

check will be sent instead. The total on line 4 must also equal the

Note. If you appeal the math error and your appeal is upheld, the

total of the amounts on lines 1a, 2a, and 3a.

resulting refund will be a paper check.

Changes in Refund Due to Math Errors or Refund Offsets

Refund offset. If your refund is used by the Comptroller of

Maryland to pay (offset) past-due federal tax, state tax or certain

The rules below explain how your direct deposits may be adjusted.

other debts (such as other state’s income tax, child support,

Math errors. The following rules apply if your refund is increased

spousal support, or certain federal non-tax debts), the offset is

or decreased due to a math error.

taken from the deposits to accounts on line 3, 2 and 1, in that

order and as applicable.

Refund increased. If you made an error on your return and the

Sample Check

TIM TAXPAYER

0004

TINA TAXPAYER

321 Happy Lane

15-0000/0000

Town, MD 20000

PAY TO THE

$

ORDER OF

DOLLARS

Do not include

Routing

Account

TOWN BANK

Town, MD 20000

check number

number

number

For

0004

:050250025

:002020"'86".

Note. The routing and account numbers may be in di erent places on your check.

COM/RAD 755

12-49

1

1 2

2