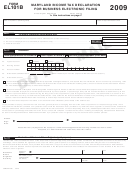

FORM

MW507P

Comptroller of Maryland

Maryland Income Tax Withholding

Revenue Administration Division

for Annuity, Sick Pay and

110 Carroll Street

Retirement Distributions

Annapolis, Maryland 21411-0001

Type or print full name

Social Security number

Home address (number & street)

City, state, and ZIP code

A.

Contract claim or identification number ...........................................................

B.

Enter the amount withheld from each annuity, sick pay or retirement

distribution payment .....................................................................................

$

I request voluntary income tax withholding from any annuity, sick pay or retirement distribution payments as authorized

by Section 10-907(b) of the Tax-General Article of the Annotated Code of Maryland.

__________________________________________________________________

__________________________________

Signature

Date

COM/RAD 044 12-49

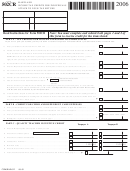

Instructions

Who may file – Any recipient of an annuity, sick pay or

You may find it convenient to request an amount to be withheld

retirement distribution payment may file this form to have

which will reduce your year-end tax balance on your individual

Maryland income tax withheld from each payment. However,

Maryland tax return to an amount of $500 or less and thus

the annuity must be payable over a period longer than one

avoid having to file an individual Declaration of Estimated Tax

year.

(Form 502D or 502 DEP).

Sick pay – The term “sick pay” means any amount which is

You may use the worksheet provided with the declaration as a

paid to an employee pursuant to a plan to which the employer

guide in estimating your income tax liability.

is a party and constitutes remuneration or a payment in lieu

Duration of withholding request

Your request for

of remuneration for any period during which the employee

voluntary

withholding

will

remain

in

effect

until

you

is temporarily absent from work on account of sickness or

terminate it.

personal injuries.

How to terminate a withholding request

You may

Where and how to file – File this form with the payer of

terminate, at any time, your request for voluntary withholding

your annuity, sick payment or retirement distribution. Enter

by giving your payers a written termination notice.

in item B of page 1, the whole dollar amount that you wish

Statement of income tax withheld

At the close of the

withheld from each annuity or sick pay payment. The amount

year, your payer will furnish you with a Form 1099 or other

must not be less than $5 a month for annuities and retirement

appropriate form showing the gross amount of annuity or sick

distributions and at least $2 per daily payment in the case of

pay payments and the total amount deducted and withheld as

sick pay.

tax during the calendar year.

File this form with the payer of your annuity, sick payment or retirement distribution.

Do not mail this form to the Maryland Revenue Administration Division

1

1