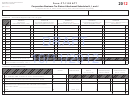

Schedule H - Expenses And Fiduciary Compensation - 2012

ADVERTISEMENT

2012

Schedule H

Massachusetts

Expenses and

Department of

Fiduciary Compensation

Revenue

Name of estate or trust

Estate or trust employer identification number

Part 1. Expense Deduction Computation

For common trust fund income, see instructions for adjustments.

11a Amount paid this year for rentals of safe deposit boxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

11b Amount paid this year for premiums on surety bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b

11 Total expenses. Add lines 1a and 1b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Total taxable Part A income. Add Schedule B, line 36 and Form 2, lines 15 and 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Total taxable and nontaxable Part A income. Add Schedule B, lines 4, 12, 13, 14, and Form 2, line 24. Then

subtract Schedule B, line 6. If common trust fund interest and dividends are not included in Schedule B, line 4,

add in the amount from Form 2, line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Divide line 2 by line 3 and enter percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

%

15 Multiply line 4 by line 1 and enter the result here and on Schedule B, line 37a. This is the maximum expense

deduction allowed against Part A income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Part 2. Fiduciary Compensation Deduction Computation

16 Total fiduciary compensation paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Total taxable 5.25% income from Form 2, line 7. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Total Part A income. Add Schedule B, lines 4, 12, 13, 14, and Form 2, line 24. Then subtract Schedule B, line 6.

If common trust fund interest and dividends are not included in Schedule B, line 4, add in the amount from Form 2,

line 15. Not less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Subtract Schedule D, line 11 from Schedule D, line 8 and add Form 2, line 32. Not less than “0” . . . . . . . . . . . . . . . . . . . . 9

10 Add lines 7 through 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Divide line 8 by line 10 and enter percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

%

12 Multiply line 11 by line 6 and enter the result here. This is the amount of fiduciary compensation

actually paid on Part A income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Add Schedule B, line 36 and Form 2, lines 15 and 24. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Total taxable and nontaxable income. Enter the amount from line 8 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Divide line 13 by line 14 and enter percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

%

16 Multiply line 15 by line 12 and enter result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Enter 7% of line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Enter here and on Schedule B, line 37b, the amount from line 16 or 17, whichever is smaller. This is the maximum

fiduciary compensation deduction allowed against Part A income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1