Instructions For Schedule U-Tm - Tax By Member - 2012

ADVERTISEMENT

Combined Reporting Instructions

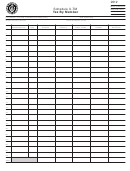

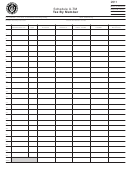

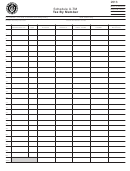

2012 Schedule U-TM Instructions

Tax by Member

Header for Schedule U-TM

Enter the name of the member (as stated on its Schedule U-ST) and its Federal Identification

number.

Column Instructions

Each line on the Schedule U-TM should match exactly to a member's Schedule U-ST.

There should be one line on the Schedule U-TM for each Schedule U-ST on the return.

Schedule U-TM, column (a) corresponds to the member's Federal Identification number

in the Schedule U-ST header.

Schedule U-TM, column (b) corresponds to the tax type in the Schedule U-ST header.

Schedule U-TM, column (c) must equal the amount in Schedule U-ST, line 30 (income

measure of excise).

Schedule U-TM, column (d) must equal the amount in Schedule U-ST, line 35 (non-

income measure of excise).

Schedule U-TM, column (e) must equal the amount in Schedule U-ST, line 36 (other

taxes due including recapture and installment sales).

Schedule U-TM, column (f) must equal the amount in Schedule U-ST, line 40 (member's

total credits against excise).

Schedule U-TM, column (g) equal the amount in Schedule U-ST, line 41 (member's net

tax liability).

Totals are requested at the bottom of columns c, d, e, f and g.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1