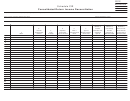

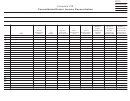

Instructions For Schedule Cir- Consolidated Return Income Reconciliation - 2012

ADVERTISEMENT

Combined Reporting Instructions

2012 Schedule CIR Instructions

Consolidated Return Income Reconciliation

Schedule CIR, Consolidated Income Reconciliation, reconciles the net income of

corporations filing in Massachusetts that are part of a U.S. consolidated return with the

consolidated net income reported to the IRS.

Taxpayers must file this schedule if their income is included in a U.S. consolidated

return. For corporations that are filing as members of a Massachusetts unitary group, only

one Schedule CIR must be filed. It must be filed by the principal reporting corporation.

Taxpayers must identify the parent corporation filing the federal consolidated return (if

different than the corporation filing the Massachusetts return) and must also report the

number of members participating in the federal consolidated return and the total assets as

shown on the consolidated Schedule L.

Taxpayers must list each corporation included in the U.S. consolidated return and its

separate company income. The total number of these entries must equal the number of

corporations participating in the return as reported in the header. A single entry is also

required for the total change to group income from all consolidation adjustments made in

reaching the U.S. consolidated return total.

The total of the amounts in column d must match the total income as shown on the U.S.

consolidated return of income before the NOL deduction or any special deductions (from

U.S. Form 1120, line 28 or equivalent).

Instructions by Column

Column a

Enter the legal name of the entity.

Column b

Enter the Federal Identification number.

Column c

01: U.S. domestic corporation

02: U.S. domestic limited liability company

04: Other domestic entity

11: Foreign (non-U.S.) entity included in the U.S. consolidated return.

98: U.S. consolidation adjustments

99: U.S. eliminations from consolidation

Column d

Enter the current year separate company income before any net operating loss deduction or

special deductions (from U.S. Form 1120, line 28 or the equivalent).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2