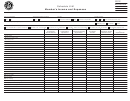

Schedule U-Nols - Member'S Shared Loss Carryover - 2012

ADVERTISEMENT

2012

Massachusetts

Schedule U-NOLS

Department of

Member’s Shared Loss Carryover

Revenue

For calendar year 2012 or taxable period beginning

2012 and ending

Member’s name

Federal Identification number

Unitary business identifier

3

3

Name of principal reporting corporation

Federal Identification number

Combined group year-end date

3

3

1 Is an affiliated group or worldwide election in effect for the current year?

Yes

No. If Yes (check one):

Affiliated group

Worldwide

12 Is the member a mutual fund service corporation?

Yes

No

Taxable Income to Which a Shared NOL May Be Applied

3 Member’s Massachusetts apportioned share of section 1231 gain or loss from this unitary business (from Schedule

U-MSI, line 33). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

4 Member’s Massachusetts apportioned share of capital gain or (loss) from this unitary business (from Schedule U-MSI,

line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Member’s Massachusetts apportioned share of income or (loss) from this business not including capital or sec.1231

gains and (losses) (from Schedule U-MSI, line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Non-deductible capital loss if attributable to this business. Enter as a positive amount (see instructions) . . . . . . . . . . . . . . . 3 6

7 Maximum taxable net income attributable to this business. Combine lines 3 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Member’s total income allocated or apportioned to Massachusetts for the tax year before deduction of any shared

NOL (from Schedule U-ST, line 26). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

9 Member’s taxable income against which a shared NOL may be taken. If the group is subject to an affiliated group

election, enter the amount from line 8 above. All other taxpayers enter the smaller of line 7 or line 8 . . . . . . . . . . . . . . . . . . 3 9

NOL of Other Members Being Deducted

10 Period end date for the oldest tax period for which any other member has an available loss which may be shared

losses from tax periods beginning prior to 2009 may not be shared. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Amount of shared NOL being deducted by this member (not greater than line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Remaining income against which shared NOL may be deducted. Subtract line 11 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Period end date for the next oldest tax period for which any other member has an available loss which may be shared . . . 3 13

14 Amount of shared NOL being deducted by this member (not greater than line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Remaining income against which shared NOL may be deducted. Subtract line 14 from line 12 . . . . . . . . . . . . . . . . . . . . . . . 15

16 Period end date for the next oldest tax period for which any other member has an available loss which may be shared . . . 3 16

17 Amount of shared NOL being deducted by this member (not greater than line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Remaining income against which shared NOL may be deducted. Subtract line 17 from line 15 . . . . . . . . . . . . . . . . . . . . . . . 18

19 Period end date for the next oldest tax period for which any other member has an available loss which may be shared . . . 3 19

20 Amount of shared NOL being deducted by this member (not greater than line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Remaining income against which shared NOL may be deducted. Subtract line 20 from line 18 . . . . . . . . . . . . . . . . . . . . . . . 21

22 Period end date for the next oldest tax period for which any other member has an available loss which may be shared . . . 3 22

23 Amount of shared NOL being deducted by this member (not greater than line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 23

24 Amount of shared NOL being deducted by this member. Combine lines 11, 14, 17, 20 and 23 . . . . . . . . . . . . . . . . . . . . . . . . 24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1