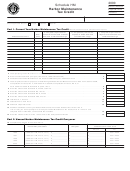

Schedule Hm - Harbor Maintenance Tax Credit - 2012

ADVERTISEMENT

2012

Massachusetts

Schedule HM

Department of

Harbor Maintenance Tax Credit

Revenue

Name

Federal Identification number

Check applicable box(es):

Shipper

Exporter

Importer

Current Year Harbor Maintenance Tax Credit.

Documentation must be provided upon request.

a. Tax paid on port use for

b. Tax paid on port use for

c. Tax paid on port use for

Date

domestic movements of break-

exports of break-bulk and

imports of break-bulk and

Massachusetts port

paid

bulk and containerized cargo

containerized cargo

containerized cargo

11 Total . . . . . . . . . . . . . . . . . . . . . . . . . . 1

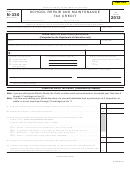

Computation of Credit

22 Total qualifying Harbor Maintenance taxes for this year. Add line 1, col’s. a through c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

23 Enter unused credit from prior year (from, 2011 Schedule HM, line 23, col. c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

24 Massachusetts Harbor Maintenance Tax Credit available this year. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

35 Total corporate excise for purposes of determining allowable Harbor Maintenance Tax Credit. Form 355,

Computation of Excise, line 6; Form 355S, Computation of Excise, line 9; or Form 355U, Schedule U-ST, line 37 . . . . . . . 5

46 Enter the amount of Vanpool Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

57 Enter the amount of ITC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

48 Enter the amount of EOAC. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

59 Enter the amount of Research Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Enter the amount of Low-Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Enter the amount of Economic Development Incentive Program Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Enter the amount of Brownfields Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Enter the amount of Historic Rehabilitation Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Enter the amount of Film Incentive Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Enter the amount of Medical Device Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Enter the amount of Life Science Credit(s) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Add lines 6 through 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Subtract line 17 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

456

19 Minimum corporate excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Maximum allowable current year Harbor Maintenance Tax Credit. Subtract line 19 from line 18. If “0” or less, you do

not qualify for a current year Harbor Maintenance Tax Credit, enter “0” in line 21 and complete lines 22 and 23 . . . . . . . 20

21 Enter the smaller of line 4 or line 20 here and on the appropriate corporate return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2