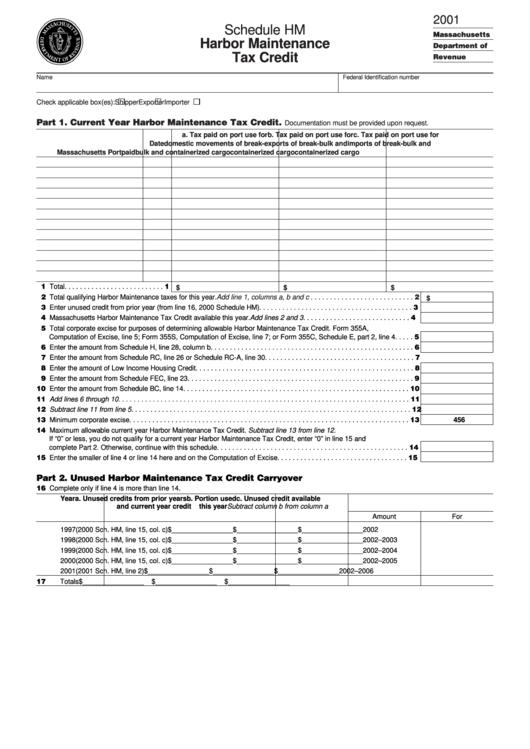

Schedule Hm - Harbor Maintenance Tax Credit Form - 2001

ADVERTISEMENT

2001

Schedule HM

Massachusetts

Harbor Maintenance

Department of

Tax Credit

Revenue

Name

Federal Identification number

Check applicable box(es):

Shipper

Exporter

Importer

Part 1. Current Year Harbor Maintenance Tax Credit.

Documentation must be provided upon request.

a. Tax paid on port use for

b. Tax paid on port use for

c. Tax paid on port use for

Date

domestic movements of break-

exports of break-bulk and

imports of break-bulk and

Massachusetts Port

paid

bulk and containerized cargo

containerized cargo

containerized cargo

11 Total . . . . . . . . . . . . . . . . . . . . . . . . . . 1

$

$

$

22 Total qualifying Harbor Maintenance taxes for this year.

Add line 1, columns a, b and c . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 $

23 Enter unused credit from prior year (from line 16, 2000 Schedule HM) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

24 Massachusetts Harbor Maintenance Tax Credit available this year. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

35 Total corporate excise for purposes of determining allowable Harbor Maintenance Tax Credit. Form 355A,

Computation of Excise, line 5; Form 355S, Computation of Excise, line 7; or Form 355C, Schedule E, part 2, line 4 . . . . . 5

46 Enter the amount from Schedule H, line 28, column b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

57 Enter the amount from Schedule RC, line 26 or Schedule RC-A, line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

58 Enter the amount of Low Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

59 Enter the amount from Schedule FEC, line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Enter the amount from Schedule BC, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Add lines 6 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Subtract line 11 from line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Minimum corporate excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

456

14 Maximum allowable current year Harbor Maintenance Tax Credit. Subtract line 13 from line 12.

If “0” or less, you do not qualify for a current year Harbor Maintenance Tax Credit, enter “0” in line 15 and

complete Part 2. Otherwise, continue with this schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Enter the smaller of line 4 or line 14 here and on the Computation of Excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Part 2. Unused Harbor Maintenance Tax Credit Carryover

16 Complete only if line 4 is more than line 14.

Year

a. Unused credits from prior years

b. Portion used

c. Unused credit available

a.

and current year credit

b.

this year

Subtract column b from column a

Amount

For

1997

(2000 Sch. HM, line 15, col. c)

$________________

$________________

$________________

2002

1998

(2000 Sch. HM, line 15, col. c)

$________________

$________________

$________________

2002–2003

1999

(2000 Sch. HM, line 15, col. c)

$________________

$________________

$________________

2002–2004

2000

(2000 Sch. HM, line 15, col. c)

$________________

$________________

$________________

2002–2005

2001

(2001 Sch. HM, line 2)

$________________

$________________

$________________

2002–2006

17

Totals

$________________

$________________

$________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1