2012

FORM

MARYLAND BUSINESS INCOME

500CR

TAX CREDITS INSTRUCTIONS

for each individual recharging system or the state income tax for

claimed.

the taxable year. Any unused credit amount for the taxable year

No credits may be earned for any tax year beginning on or after

may not be carried forward to any other taxable year.

January 1, 2017.

To claim the credit, an individual or corporation shall apply with the

For more information, contact:

Maryland Energy Administration (MEA) for initial credit certificate

Maryland Department of Business and Economic Development

for the number of individual recharging systems. No credit may

401 E. Pratt St.

be earned for any tax year beginning on or after January 1, 2014.

Baltimore, MD 21202

For additional information, contact:

410-767-4980

Maryland Energy Administration

60 West Street, Suite 300

PART T - JOB CREATION AND RECOVERY TAX CREDIT

Annapolis, MD 21401

410-260-7655

General Requirements: The Job Creation & Recovery Tax Credit

has expired. This credit was available to employers who hired

NOTE: A copy of the certification(s) by Maryland Energy

qualified employees on or after March 25, 2010 but before January

Administration must be included with form 500CR.

1, 2011. The credit was available for those employees hired and

for the first 12 months of employment. See 2011 instructions for

PART W - BUSINESS TAX CREDIT SUMMARY

more information.

This part is to summarize all available tax credits reported on this

form. If the total credits available in a particular tax year exceed

This credit may still be available on the 2012 Form 500CR for

the tax developed for that year, the excess may not be refunded.

members of pass-through entities(PTE) with a fiscal year beginning

An addition to income is required for credits from Parts A, C, G,

in 2011 and ending in 2012, if there was an amount of the original

K and S.

credit due to the qualified employees first 12 months of employment

expiring in the PTE’s 2011 fiscal year.

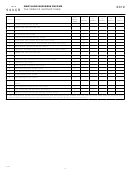

PART X - EXCESS CREDIT CARRYOVER CALCULATION

If a taxpayer with a 2012 Tax Year has received the PTE’s Fiscal

Most credits may not exceed the Maryland income tax liability, but

Year 2011 Maryland K-1 during Tax Year 2012, the PTE member

may be carried forward for a specified number of successive tax

may claim the distributive or pro rata share of the credit that is

years or until fully applied. It is your responsibility to maintain a

reported on the Maryland Schedule K-1.

record of credits for which you qualify, credits that have been taken

in prior years, and the amount of each credit that may be carried

This credit will only be allowed to the PTE member, if the PTE

forward. To assist you, the following table provides the number of

had completed and filed the Maryland Form 500CR, submitted the

years for which each credit may be carried forward.

required certifications, and had no existing liability to Maryland

and this amount had not been previously claimed.

PART Y - REFUNDABLE BUSINESS INCOME TAX CREDITS

Part Y is used to report the refundable portion of the One Maryland

PART U - FILM PRODUCTION EMPLOYMENT TAX CREDIT

Economic Development Tax Credit from Part P, the Biotechnology

A qualified film production entity may claim a credit against the state

Investment Incentive Tax Credit from Part L, the Clean Energy

income tax for film production activities in the state in an amount

Incentive Tax Credit from Part N, the Job Creation and Recovery

equal to the amount stated in the final tax credit certificate approved

Tax Credit from Part T and the Film Production Employment Credit

by the Department of Business and Economic Development (DBED).

from Part U.

If the tax credit allowed exceeds the total tax otherwise payable

by the qualified film production entity for that taxable year, the

qualified film production entity may claim a refund in the amount

of the excess.

To claim the credit, before beginning a film production activity, a

qualified film production entity shall apply with DBED for an Initial

credit certificate for the estimated production costs The credit

claimed cannot exceed the amount stated In the final certificate.

No credit may be earned for any fiscal year beginning on or after

July 1, 2014.

For additional information, contact:

Jack Gerbes, Director

Maryland Film Office

Maryland Department of Business and Economic Development

401 E Pratt Street, 14th Floor

Baltimore, MD 21202

410-767-6343

NOTE: A copy of the certification by DBED must be included with

form 500CR.

PART V - ELECTRIC VEHICLE RECHARGING EQUIPMENT

TAX CREDIT

An individual or corporation may claim a credit against the state

income tax in an amount equal to 20 percent of the cost of any

qualified electric vehicle recharging equipment placed in service by

the taxpayer during the tax year. The credit may not exceed $400

12-49

9

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17