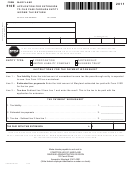

FORM

MARYLAND COMPOSITE

2012

510C

PASS-THROUGH ENTITY INCOME

TAX RETURN INSTRUCTIONS

GENERAL INSTRUCTIONS

notify the pass-through entity of any balance due.

Pass-through entities (PTEs) may use Form 510C to file a composite

Line 16 Total Balance Due. Add the amounts on lines 13 and 15 and

income tax return on behalf of eligible nonresident individual members.

enter the result, or if the amount on line 15 exceeds line 14,

Nonresident members other than individuals may not participate

enter the difference. The total amount due must be paid with

in the composite return. The Maryland tax of each nonresident

the filing of Form 510C.

individual member is calculated using the rate of 5.75% plus the 1.25%.

Schedule A Instructions. Complete the following for each eligible

SPECIFIC INSTRUCTIONS

nonresident individual member who has elected to be included on this

composite return.

Who may use this form. Nonresident individual members of a

PTE doing business in the State who meet the composite return

Column A Member’s full name and Social Security number.

requirements contained in Administrative Release 6 and elect to be

Column B Member’s number of exemption allowance.

included in a composite return may not be required to file Maryland

nonresident returns individually. Instead, the PTE doing business in

Column C Member’s exemption amount. See instruction for Form

the State may file a composite return on behalf of such nonresident

510C, line 4.

individual members if:

Column D Member’s standard deduction. See instruction for Form

1. Form 510C accurately reflects the Maryland taxable income and

510C, line 5.

tax liability of each individual member shown on the return, AND

Column E Member’s share of decoupling modification flow-through

2. Form 510C Schedule A is attached containing all required

from the PTE. See instruction for Form 510C, line 7.

information for each individual member, AND

Column F Member's pro rata share of income allocable to Maryland;

3. The PTE pays the tax, interest and penalty due by each individual

this is generally the member's portion of what is reported

member shown on the return.

on line 4 of Form 510.

Any overpaid amount will be refunded to the PTE. For more

Column G Member’s pro rata share of the nonresident withholding

information, Administrative Release 6 may be obtained from our Web

tax paid; it is the member’s portion of what is reported on

site at

line 16d and line 17 of Form 510.

Line 2

Enter the number of eligible nonresident individual members

Direct Deposit of Refund. In order to comply with banking rules,

who have elected to be included on this composite return.

we ask you to indicate on your return if the state refund is going to an

Fiduciaries are not eligible and cannot be included.

account outside the United States. If you indicate that this is the case,

do not enter your routing and account numbers, as the direct deposit

Line 4

Enter the total exemption amount reported on Column C,

option is not available to you. We will send you a paper check. Complete

Form 510C Schedule A. The exemption amount allowed for

lines 18a, b and c of Form 510C if you want us to deposit your refund

each nonresident individual member must be determined

directly into your account at a bank or other financial institution (such

separately based on the individual member’s filing status.

as a mutual fund, brokerage firm or credit union) in the United States.

Generally, a nonresident is allowed the same number

Signature Verification. An authorized general partner, officer or

of exemptions that the nonresident is permitted on the

member of the PTE must sign and date Form 510C and enter his or

federal return; however, the exemption amount is different,

her title. If a preparer is used, the preparer must also sign the return

and is further prorated by the nonresident’s Maryland

and enter the firm’s name, address and Preparer’s Tax Identification

income factor. See Instruction 10 of Form 505, Maryland

Number (PTIN). Penalties may be imposed for tax preparers who fail

Nonresident Income Tax Return to determine the exemption

to sign the tax return and provide their Preparer’s Tax Identification

amount before multiplying it by the Maryland income factor,

Number.

which is the nonresident’s Maryland adjusted gross income

(generally from Form 510C, Schedule A, Column F) divided

Attachments and Mailing Instruction. Mail the completed return

by the nonresident’s federal adjusted gross income (FAGI). If

and all required attachments to Comptroller of Maryland, Revenue

it is impracticable to determine all of the separate Maryland

Administration Division, 110 Carroll Street, Annapolis, MD

income factors, then the factor must be determined by using

21411-0001. Must attach with Form 510C: (1) Form 510C Schedule A,

line 6 of Form 510 as the numerator (excluding the portion

(2) the PTE’s Form 510 Schedule B, Part I for individual members; and

applicable to nonresident fiduciary members) and line 2 of

(3) the members’ Form 510 Schedule K-1 issued by the PTE.

Form 510 as the denominator (See Administrative Release

Extension of time to File. Use Form 502E to file an extension and

6).

make payment. See Administrative Release 4.

Line 5

Enter the total standard deduction amount reported on

Amended Returns. If filing an amended return, check the Amended

Column D, Form 510C, Schedule A. The standard deduction

Return box on page 1 of Form 510C.

amount allowed for each nonresident individual member

must be determined separately based on the individual

Privacy Act Information. The Tax-General Article of the Annotated

member's Maryland adjusted gross income, and then

Code of Maryland authorizes the Revenue Administration Division to

prorated by the nonresident’s Maryland income factor. See

request information on tax returns to administer the income tax laws of

Instruction 15 of Form 505, Maryland Nonresident Income

Maryland, including determination and collection of correct taxes. Code

Tax Return for determining the standard deduction amount.

Section 10-804 provides that you must include your Social Security

See the instruction for line 4 for the nonresident individual

number on the return you file. This is so we know who you are and can

member’s Maryland income factor.

process your return and papers. If you fail to provide all or part of the

requested information, then applicable exemptions, credits, deductions

Line 7

Enter the total PTE flow-through decoupling modification

or adjustments may be disallowed and you may owe more tax. In

amount reported on Column E, Form 510C.

No flow-

addition, the law provides penalties for failing to supply information

through addition or subtraction modifications, other than the

required by law or regulations. You may look at any records held by

modification required as a result of Maryland’s decoupling

the Revenue Administration Division which contain personal information

from the additional depreciation allowance and special 5-year

about you. You may inspect such records, and you have certain rights to

net operating loss carryback provisions may be claimed on a

amend or correct them. As authorized by law, information furnished to

composite return. See Administrative Release No. 38.

the Revenue Administration Division may be given to the United States

Line 15 If there is a balance due on line 13, interest may be due

Internal Revenue Service, a proper official of any state that exchanges

as result of late filing of Form 510C and payment of tax.

tax information with Maryland and to an officer of this State having a

Interest is due at the rate of 13% annually or 1.08% per

right to the information in that officer’s official capacity. The information

month for any month or part of a month that a tax is paid

may be obtained in accordance with a proper legislative or judicial order.

after the original due date of the return. The Maryland

Revenue Administration Division will calculate the interest

and penalty for failure to pay the required amount of tax and

COM/RAD 071

12-49

1

1 2

2 3

3