Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2013 Page 3

ADVERTISEMENT

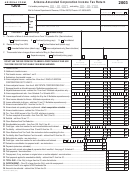

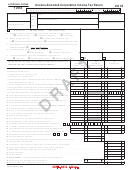

Arizona Form 120X

Pollution Control Credit. This tax credit is for

Credit for Corporate Contributions to School

expenses incurred during the taxable year to purchase

Tuition Organizations. This credit is for corporations

real or personal property used in the taxpayer's trade or

who make contributions to school tuition organizations

business in Arizona to control or prevent pollution.

which provide scholarships and tuition grants to

Complete Form 315 to claim this tax credit.

children attending qualified nongovernmental schools.

Use Form 335 to claim this tax credit.

Credit for Taxes Paid for Coal Consumed in

Credit for Solar Energy Devices - Commercial and

Generating Electrical Power. This tax credit is for a

Industrial Applications. This credit is available to

percentage of the amount paid by the seller or purchaser as

taxpayers that install solar energy devices for

transaction privilege tax or use tax for coal sold to the

commercial, industrial, or any other nonresidential

taxpayer that is consumed in the generation of electrical

purpose in the taxpayer’s trade or business located in

power in Arizona. "Amount paid by the seller or purchaser

Arizona. The taxpayer or an exempt organization may

as transaction privilege tax or use tax" means that the

transfer the credit to a third party that either financed,

Arizona transaction privilege tax was passed through to the

installed, or manufactured the qualifying solar energy

taxpayer by the seller as an added charge or that the seller

device. Use Form 336 to figure this tax credit.

collected the Arizona use tax from the taxpayer or that the

taxpayer paid the Arizona use tax to the department.

Credit for Water Conservation System Plumbing

Complete Form 318 to claim this tax credit.

Stub Outs. The credit for water conservation system

plumbing stub outs has expired. This credit may not be

Credit for Solar Hot Water Heater Plumbing Stub

claimed for taxable years ending after December 31,

Outs and Electric Vehicle Recharge Outlets. This tax

2011. However, any credit carryover established in

credit is for the installation of solar hot water heater

calendar year 2011 and prior will be allowed for not

plumbing stub outs and electric vehicle recharge outlets

more than five consecutive taxable years. Use Form 337

in houses or dwelling units constructed by the taxpayer.

to figure any allowable credit carryover.

The houses or dwelling units must be located in

Arizona. Complete Form 319 to claim this tax credit.

Credit for Corporate Contributions to School

Tuition Organizations for Displaced Students or

Credit for Employment of TANF Recipients. This tax

Students With Disabilities. This tax credit is for

credit is for net increases in qualified employment for

corporations who make contributions to school tuition

recipients of temporary assistance for needy families

organizations that provide scholarships and tuition

(TANF) who are residents of Arizona. Complete

grants to qualifying children attending qualified

Form 320 to claim this tax credit.

nongovernmental schools. Use Form 341 to claim this

Agricultural Pollution Control Equipment Credit.

tax credit.

This tax credit is for expenses incurred during the

Renewable Energy Production Tax Credit. This tax

taxable year to purchase tangible personal property that

credit is for taxpayers that produce electricity using

is primarily used in the taxpayer’s business in Arizona

qualified energy resources. Approval by the Arizona

to control or prevent agricultural pollution. Complete

Department of Revenue is required prior to claiming

Form 325 to claim this tax credit.

this tax credit. Use Form 343 to claim this tax credit.

Credit for Donation of School Site. This tax credit is

Solar Liquid Fuel Credit. This tax credit is for

for the donation of real property and improvements to

taxpayers that increase research activities related to

an Arizona school district or Arizona charter school for

solar liquid fuel. Additional credits will become

use as a school or as a site for the construction of a

available in 2016 for production and delivery system

school. Complete Form 331 to claim this tax credit.

costs. Use Form 344 to claim this tax credit.

Credits for Healthy Forest Enterprises. These tax credits

Credit for New Employment. This tax credit is for

are for net increases in qualified employment positions in a

taxpayers that have net increases in employment. The

healthy forest enterprise and net training and certifying

credit limit is administered by the Arizona Commerce

costs. Use Form 332 to claim these tax credits.

Authority. Use Form 345 to claim this tax credit.

Credit for Employing National Guard Members.

Additional Credit for Increased Research Activities

This credit is for an employer who has an employee that

for Basic Research Payments. This tax credit is for

is a member of the Arizona National Guard and the

taxpayers that make qualified basic research payments

employee was placed on active duty. Use Form 333 to

for research conducted in Arizona. Approval by the

claim this tax credit.

Arizona Department of Revenue is required prior to

claiming this tax credit. Use Form 346 to claim this tax

Motion Picture Credits. Motion picture production

credit.

companies that produced motion pictures, commercials,

music videos, or television series completely or partially in

Credit for Qualified Health Insurance Plans. This tax

Arizona may claim a transferable income tax credit for

credit is for employers that provide qualified health

production costs. To qualify, productions must have been

insurance plans or contribute to health savings accounts

preapproved by the Arizona Commerce Authority by

for its employees who are Arizona residents. Use

December 31, 2010. Use Form 334 to claim this tax credit.

Form 347 to claim this tax credit.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6