Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2013 Page 4

ADVERTISEMENT

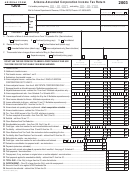

Arizona Form 120X

Credit for Qualified Facilities. This tax credit is for expanding

Complete the appropriate credit form for each credit. Attach

or locating a qualified facility in Arizona and is refundable in

the completed credit form(s) to Form 120X with Form 300,

five equal installments. Pre-approval and post-approval are

whether or not the amount claimed on line 19 has changed.

required through the Arizona Commerce Authority. Attach a

Line 20 - Credit Type

copy of your "Certification of Qualification" from the Arizona

Indicate which tax credits were claimed on line 19 by

Commerce Authority and Form 349 to your tax return to claim

entering the applicable form number(s) in the space provided.

this credit. Enter the amount from Form 349, Part VI, line 18.

Complete this line whether or not the amount of tax credits

If you are claiming more than one of the refundable tax credits,

claimed on line 19 has changed.

check the appropriate boxes and add the amounts from the

Nonrefundable Income Tax Credit

Form

credit forms together and enter the total on line 22, or use the

Enterprise Zone Credit

304

worksheet below to figure the amount to enter on line 22.

Environmental Technology Facility Credit

305

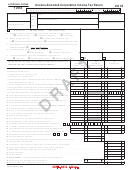

Refundable Credit Worksheet

Military Reuse Zone Credit

306

Credit for Increased Research Activities

308

1. Enter the refundable credit from

Pollution Control Credit

315

Form 308, Part VI, line 46.

Credit for Taxes Paid for Coal Consumed in Generating

318

Electrical Power

2. Enter the apportioned credit from

Credit for Solar Hot Water Heater Plumbing Stub Outs

Form 342, Part VI, line 18.

319

and Electric Vehicle Recharge Outlets

3. Enter the apportioned credit from

Credit for Employment of TANF Recipients

320

Form 349, Part VI, line 18.

Agricultural Pollution Control Equipment Credit

325

Credit for Donation of School Site

331

4. Add the amounts on lines 1, 2,

Credits for Healthy Forest Enterprises

332

and 3. Enter the total here and on

Credit for Employing National Guard Members

333

Form 120X, line 22.

Motion Picture Credits

334

Line 23 - Payments (Extension, Estimated)

Credit for Corporate Contributions to School Tuition

335

Organizations

Enter the total amount from the original return (2013 Form 120,

Credit for Solar Energy Devices - Commercial and

336

lines 23 and 24; or 2013 Form 120A, lines 15 and 16).

Industrial Applications

Credit for Water Conservation System Plumbing Stub Outs

337

Line 24 - Payment With Original Return (Plus All

Credit for Corporate Contributions to School Tuition

Payments After It Was Filed)

Organizations for Displaced Students or Students With

341

Disabilities

Enter the amount from page 2, Schedule D, line D4.

Renewable Energy Production Tax Credit

343

Solar Liquid Fuel Credit

344

Line 25 - Total Payments

Credit for New Employment

345

Additional Credit for Increased Research Activities for

Add lines 22, 23 and 24. Enter the total.

346

Basic Research Payments

NOTE FOR CLAIM OF RIGHT RESTORATION: If the

Credit for Qualified Health Insurance Plans

347

tax for the taxable year 2013 was computed under the provisions

Line 22 - Refundable Tax Credits

for a claim of right restoration, line 25 also includes the credit

Check the box marked 308, 342 and/or 349 to indicate which

for the tax reduction for prior taxable year(s). Refer to Arizona

of these tax credits the taxpayer is claiming. Enter the total

Corporate Income Tax Procedure CTP 95-3 for further

amount of the credits claimed on line 22. Attach the

information. Write "A.R.S. § 43-1130.01" and the total amount

completed credit form(s) to Form 120X, whether or not the

of the tax reduction for prior taxable year(s) in the space to the

amount claimed on line 22 has changed.

left of the total payment amount entered on line 25. The amount

Credit for Increased Research Activities. A portion of this

entered on line 25 is the total of lines 22, 23 and 24 and the tax

tax credit is refundable for qualified taxpayers. The refund is

reduction for prior taxable year(s). Attach a schedule computing

limited to 75% of the excess credit, which is the current year's

the tax reduction for the prior taxable year(s).

credit less the current year's tax liability, not to exceed the

amount approved by the Arizona Commerce Authority.

Line 26 - Overpayment From Original Return or as

Attach a copy of your "Certificate of Qualification" from the

Later Adjusted

Arizona Commerce Authority, Form 300 and Form 308 to

Enter the amount of any overpayment of tax from the original

your return. Enter the amount from Form 308, Part VI,

return (2013 Form 120, line 31; or 2013 Form 120A, line 23),

line 46.

and the total amount of any overpayments of tax from a

Credit for Renewable Energy Industry. This tax credit is for

Department of Revenue correction notice, a previously filed

expanding or locating qualified renewable energy operations

amended return (2013 Form 120X, line 31), or an audit.

in Arizona and is refundable in five equal installments. Pre-

approval and post-approval are required through the Arizona

Line 28 - Total Due

Commerce Authority. Attach a copy of your "Certification of

If line 21, column (c) is larger than line 27, enter the

Qualification" from the Arizona Commerce Authority and

difference. This is the amount of tax due.

Form 342 to your tax return to claim this credit. Enter the

amount from Form 342, Part VI, line 18.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6