Name (as shown on page 1)

EIN

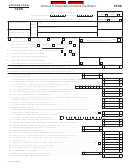

Schedule A – Apportionment Formula (Multistate S Corporations Only)

• Qualifying air carriers must use Arizona Schedule ACA.

• See instructions, pages 8 and 9.

COlumN A

COlumN B

COlumN C

Total Within Arizona

Total Everywhere

Ratio Within Arizona

Round to nearest dollar.

Round to nearest dollar.

A ÷ B

A1 Property Factor

Value of real and tangible personal property (by averaging the value

of owned property at the beginning and end of the tax period; rented

property at capitalized value).

a Owned property (at original cost):

Inventories ........................................................................................

Depreciable assets – (do not include construction in progress) .......

land ..................................................................................................

Other assets – (describe)

(

) (

)

less – Nonbusiness property (if included in above totals) ...............

Total of section a ...............................................................................

b Rented property (capitalize at 8 times net rental paid) .....................

c Total owned and rented property (section a total plus section b)

•

A2 Payroll Factor

Total wages, salaries, commissions and other compensation paid to

employees (per federal Form 1120-S or payroll reports) .....................

•

A3 Sales Factor

a Sales delivered or shipped to Arizona purchasers ............................

b Other gross receipts .........................................................................

c Total sales and other gross receipts .................................................

× 2 OR × 8

d Weight AZ sales – (STANDARD uses ×2; ENHANCED uses ×8) ....

e Sales factor (For column A, multiply line c by line d;

for column B, enter the amount from line c.) .....................................

•

A4 Total Ratio – add A1c, A2, and A3e, in column C ...................................................................................................................

•

A5 Average Apportionment Ratio – divide line A4, column C, by the denominator (STANDARD divides by four (4);

ENHANCED divides by ten (10)). Enter the result in column C, and on page 1, line 7 ..........................................................

•

Schedule B – Other Information

m m D D y y y y

B1 Date business began in Arizona or date income was first derived from Arizona sources:

B2 Address at which tax records are located for audit purposes:

Street:

City:

State:

ZIP Code:

B3 The taxpayer designates the individual listed below as the person to contact to schedule an audit of this return and authorizes the disclosure of

confidential information to this individual. (See instructions, page 9.)

Name:

Title:

Phone:

B4 list prior taxable years for which a federal examination has been finalized:

NOTE: A.R.S. § 43-327 requires the taxpayer, within ninety days after final determination, to report these changes under separate cover to the

Arizona Department of Revenue or to file amended returns reporting these changes. (See instructions, page 1.)

$

00

B5 Amount of net income subject to Arizona corporate income tax for prior taxable year (2012 Form 120S, line 11.) .............

B6 Indicate tax accounting method:

Cash

Accrual

Other (Specify method.)

PLEASE BE SURE TO SIGN THE RETURN ON PAGE 3.

ADOR 10337 (13)

AZ Form 120S (2013)

Page 2 of 3

1

1 2

2 3

3