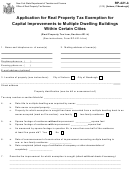

Instructions For Form Rp-421-K - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Page 2

ADVERTISEMENT

RP-421-k-Ins (1/13) (back) [Auburn, C/Newburgh]

Unless limited by local law, the value of an improvement qualifying for exemption should receive the following

exemption percentages:

Year

Exemption percentage

1

100

2

87.5

3

75

4

62.5

5

50

6

37.5

7

25

8

12.5

Authorized limitations

The local law or resolution may limit the maximum value of an improvement which may receive exemption to

an amount less than the statutorily prescribed $100,000, but not less than $10,000.

The percentage of exemption may be reduced. This means that the percentage of exemption otherwise

allowed in any of the eight years listed above may be equal to or less than the state-authorized percentage.

For example, the local law could provide for an exemption of 75% for three years, followed by an exemption of

37.5% for three years. An exemption of 37.5% for eight years would not be allowable since that would exceed

the state limit in years seven and eight.

The state law applies to “reconstruction, alterations or improvements,” but the local law or resolution may limit

the exemption to specific forms of reconstruction, alteration, or improvement. The exemption also may be

limited only to improvements which prevent physical deterioration of the existing structure or which bring it into

compliance with applicable building, sanitary, health or fire codes.

Filing application

Application must be filed with the city assessor. Do not file the application with the Office of Real Property Tax

Services.

Time of filing application

The application must be filed in the assessor’s office on or before the appropriate taxable status date. The

taxable status date of the City of Auburn is February 1; the taxable status date of the City of Newburgh is

March 1.

Once the exemption has been granted, it is not necessary to reapply for the exemption after the initial year in

order for the exemption to continue. There is no need to reapply in subsequent years, but if the property

ceases to be used primarily for residential purposes, or if title to the property is transferred to persons other

than the heirs or distributees of the owner, the exemption is terminated. The exemption will automatically be

recalculated in any year in which there is a change in level of assessment for the final assessment roll of 15%

or more. No local law or resolution may repeal or reduce an exemption granted pursuant to section 421-k until

expiration of the period of that exemption.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362237/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362242/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362247/page_1_thumb.png)

![Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3207/320781/page_1_thumb.png)

![Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-i [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320837/page_1_thumb.png)

![Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Form Rp-421-j [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3208/320854/page_1_thumb.png)