Massachusetts - Weekly Payroll Records Report & Statement Of Compliance Form Page 2

ADVERTISEMENT

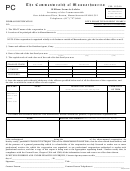

MASSACHUSETTS WEEKLY CERTIFIED PAYROLL REPORT FORM

Company's Name:

Address:

Phone No.:

Payroll No.:

Employer's Signature:

Title:

Contract No:

Tax Payer ID No.

Work Week Ending:

Awarding Authority's Name:

Public Works Project Name:

Public Works Project Location:

Min. Wage Rate Sheet No.

General / Prime Contractor's Name:

Subcontractor's Name:

"Employer" Hourly Fringe Benefit Contributions

(B+C+D+E)

(A x F)

Project

Project Gross

Hours

Health &

Wages

Hours

Worked

(G)

Employee is

Appr.

(A)

Hourly Base

Welfare

ERISA

Supp.

Total Hourly

OSHA 10

Rate

Wage

Insurance

Pension Plan

Unemp.

Prev. Wage

Check No.

All Other

Total Gross

Employee Name & Complete Address

Certified (?)

Work Classification:

(%)

Su.

Mo.

Tu.

We.

Th.

Fr.

Sa.

(B)

(C')

(D)

(E)

(F)

(H)

Hours

Wages

NOTE:

Pursuant to MGL Ch. 149 s.27B, every contractor and subcontractor is required to submit a "true and accurate" copy of their weekly payroll records directly

to the awarding authority. Failure to comply may result in the commencement of a criminal action or the issuance of a civil citation.

Date recieved by awarding authority

Page

of

/

/

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2