Form 150-303-051 - Oregon Enterprise Zone Annual Statement Of Compliance

ADVERTISEMENT

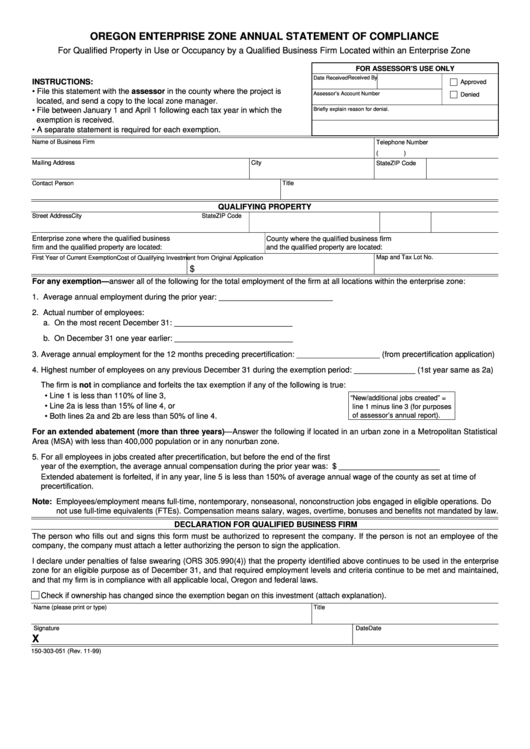

OREGON ENTERPRISE ZONE ANNUAL STATEMENT OF COMPLIANCE

For Qualified Property in Use or Occupancy by a Qualified Business Firm Located within an Enterprise Zone

FOR ASSESSOR’S USE ONLY

Received By

Date Received

INSTRUCTIONS:

Approved

• File this statement with the assessor in the county where the project is

Assessor’s Account Number

Denied

located, and send a copy to the local zone manager.

Briefly explain reason for denial.

• File between January 1 and April 1 following each tax year in which the

exemption is received.

• A separate statement is required for each exemption.

Name of Business Firm

Telephone Number

(

)

Mailing Address

City

State

ZIP Code

Title

Contact Person

QUALIFYING PROPERTY

Street Address

State

ZIP Code

City

Enterprise zone where the qualified business

County where the qualified business firm

firm and the qualified property are located:

and the qualified property are located:

Map and Tax Lot No.

First Year of Current Exemption

Cost of Qualifying Investment from Original Application

$

For any exemption—answer all of the following for the total employment of the firm at all locations within the enterprise zone:

1. Average annual employment during the prior year: __________________________

2. Actual number of employees:

a. On the most recent December 31: ___________________________

b. On December 31 one year earlier: ___________________________

3. Average annual employment for the 12 months preceding precertification: ___________________ (from precertification application)

4. Highest number of employees on any previous December 31 during the exemption period: ______________ (1st year same as 2a)

The firm is not in compliance and forfeits the tax exemption if any of the following is true:

• Line 1 is less than 110% of line 3,

“New/additional jobs created” =

• Line 2a is less than 15% of line 4, or

line 1 minus line 3 (for purposes

of assessor’s annual report).

• Both lines 2a and 2b are less than 50% of line 4.

For an extended abatement (more than three years)—Answer the following if located in an urban zone in a Metropolitan Statistical

Area (MSA) with less than 400,000 population or in any nonurban zone.

5. For all employees in jobs created after precertification, but before the end of the first

year of the exemption, the average annual compensation during the prior year was: $ _______________________

Extended abatement is forfeited, if in any year, line 5 is less than 150% of average annual wage of the county as set at time of

precertification.

Note: Employees/employment means full-time, nontemporary, nonseasonal, nonconstruction jobs engaged in eligible operations. Do

not use full-time equivalents (FTEs). Compensation means salary, wages, overtime, bonuses and benefits not mandated by law.

DECLARATION FOR QUALIFIED BUSINESS FIRM

The person who fills out and signs this form must be authorized to represent the company. If the person is not an employee of the

company, the company must attach a letter authorizing the person to sign the application.

I declare under penalties of false swearing (ORS 305.990(4)) that the property identified above continues to be used in the enterprise

zone for an eligible purpose as of December 31, and that required employment levels and criteria continue to be met and maintained,

and that my firm is in compliance with all applicable local, Oregon and federal laws.

Check if ownership has changed since the exemption began on this investment (attach explanation).

Name (please print or type)

Title

Signature

Date

Date

X

150-303-051 (Rev. 11-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1