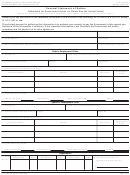

UNITED STATES BANKRUPTCY COURT

DISTRICT OF OREGON

In re

) Case No. ________________

)

)

EX. D-2

) FINANCIAL REVIEW OF DEBTOR'S

) NON-FARMING/NON-FISHING BUSINESS

) [File With Statement of Financial Affairs in

)

Chapter 12/13 Cases If Debtor Earns Any

) Income From Operation of a NON-FARMING/NON-FISHING

) Sole Proprietorship Business or Debtor or an Insider Owns 20%

Debtor(s)

) or More of a NON-FARMING/NON-FISHING Corporation]

(NOTE:

information directly related to the NON-farming/NON-fishing business operation. This information

ONLY INCLUDE

is to be from the corporate books where necessary.

If an item of Income or Expense does not apply indicate with "N/A.")

ATTACH COPY OF SCHEDULE C FROM PRIOR YEAR'S TAX RETURN (OR EXPLAIN ABSENCE).

Cash Basis

Accrual Basis

INDICATE ACCOUNTING METHOD USED:

BUSINESS NAME, ADDRESS AND PHONE NUMBER: _____________________________________________________________

_____________________________________________________________________________________________________________

NATURE AND STARTING DATE OF BUSINESS AND PERCENTAGE OF OWNERSHIP: ________________________________

_____________________________________________________________________________________________________________

PROJECTED ANNUAL BUSINESS INCOME:

1. Gross Sales or Receipts

$_________________

2. Returns and Allowances

(_________________)

3. Less Cost of Goods Sold

(_________________)

4. Other Income

_________________

5. Gross Income

$_________________

PROJECTED ANNUAL BUSINESS EXPENSES (DO NOT Include Payments Paid Through Plan):

6. Advertising

_________________

7. Car and Truck Expenses

_________________

8. Commissions and Fees

_________________

9. Secured Debt Including Interest (attach list)

_________________

10. Employee Benefits (other than on line 14)

_________________

11. Insurance (other than health)

_________________

12. Legal and Professional Services

_________________

13. Office Expenses

_________________

14. Pension/Profit-Sharing Plans

_________________

15. Rent or Leases

_________________

a. Vehicles, Machinery, Equipment (attach list)

_________________

b. Other Business Property (attach list)

_________________

16. Repairs and Maintenance

_________________

17. Supplies (if not included in line 3)

_________________

18. Taxes and Licenses

a. Payroll Taxes

_________________

b. Income/Self-Employment Tax

_________________

c. Other Taxes/Licenses

_________________

19. Travel

_________________

20. Meals and Entertainment

_________________

21. Utilities

_________________

22. Wages

_________________

23. Other expenses (list separately): __________________________

_________________

_____________________________________________________

_________________

_____________________________________________________

_________________

24. Total Expenses

$_________________

(line 5 less line 24)

$_________________

PROJECTED ANNUAL NET INCOME

$_________________

ESTIMATED AVERAGE NET MONTHLY INCOME

(Attach explanation if not same as amount listed on Schedule I for the question "Regular income from operation of business ...")

Exhibit D-2 (10/17/05)

1

1