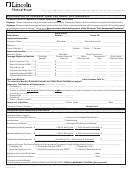

COMPLETING YOUR BENEFICIARY DESIGNATION FORM

1.

At the top of the form, fill in the information regarding your employer and yourself.

2.

Next complete the information regarding who will be your primary and contingent beneficiaries. A primary beneficiary will be

the person/people that you want to receive the life insurance benefit. The contingent beneficiary or beneficiaries will only receive

the life insurance benefit if the primary beneficiary(ies) is no longer living. Indicate the percentage of the benefit amount that the

beneficiary will receive. Do not use dollar amounts. Percentages must add up to 100%.

3.

If you live in a community property state, are married and naming someone other than your spouse as the primary beneficiary, you

should have your spouse sign this form to avoid any delays at claim time.

4.

Sign and date the form.

Below is an example of how to complete the beneficiary designations:

PRIMARY BENEFICIARY(IES)

Social Security

Relationship

Date of

Percentage:

Primary Beneficiary’s Name and Address

Number

to You

Birth

Must equal 100%

Name:

Jill Doe

xxx-xx-xxxx

Wife

xx/xx/xx

100%

Address:

123 Main St, Anytown, NE 00000

Name:

Address:

Name:

Address:

CONTINGENT BENEFICIARY(IES):

Contingent beneficiaries will only receive benefit if there are no surviving primary beneficiaries.

Social Security

Relationship

Date of

Percentage:

Contingent Beneficiary’s Name and Address

Number

to You

Birth

Must equal 100%

Name:

John Doe Sr

xxx-xx-xxxx

Father

xx/xx/xx

50%

Address:

456 Main Ln, Anytown, NE 00000

Name:

Mary Doe

xxx-xx-xxxx

Sister

xx/xx/xx

25%

Address:

789 Main Rd, Anytown, NE 00000

Name:

Jack Doe Irrevocable Trust, Jill Doe TTEE UTA 1/04

xxx-xx-xxxx

Trust

25%

Address:

123 Main St, Anytown, NE 00000

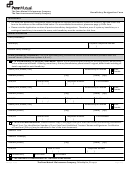

FREqUENTLY ASkED qUESTIONS

Should I name a minor child as a beneficiary?

You may name a minor child as a beneficiary, however please be aware that we cannot make payment of a claim directly to a minor. If

a claim is incurred we would need to make payment to the guardian of the minor’s financial estate or pay the funds into a Secureline

Minor Account.

How would I name a Charitable Organization as a beneficiary?

A charitable organization that is not your employer may be named as a beneficiary. You will need to indicate the name of the charitable

organization, a contact for the organization, their tax identification number, and the percentage of the benefit that would be payable to them.

How do I name my Estate as the beneficiary?

You may name your estate as a beneficiary. To name your estate as the beneficiary indicate “My Estate” as the beneficiary. If you

know who will be the executor or administrator of your estate you should also include that person’s name. For example: My Estate, John

Doe Executor.

How do I name a Trust as the beneficiary?

You may designate a trust as a beneficiary. To name a trust as a beneficiary, indicate Trustee (show Name and address) under Trust

Agreement Dated (show date). If the trust has a tax identification number that will need to be supplied in place of the social security

number. For example: Jack Doe Irrevocable Trust, Jill Doe TTEE UTA 1/1/04.

Page 2 of 2

GLC-02170

10/08

1

1 2

2