FILING INSTRUCTIONS

(Instructions Updated 09/01/07)

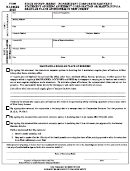

Wage Chart

VWC Form No. 7A

The information at the top right of the form should be provided by the insurer. Please note that the

insurer code refers to the five-digit numeric code assigned by The National Counsel on Compensation

Insurance (NCCI). Self-insured employers are assigned a similar five-digit code number by the

Virginia Workers’ Compensation Commission.

Illegible forms will be returned to the insurer.

How to complete the Wage Chart:

•

Indicate gross weekly earnings for the 52 weekly periods immediately preceding the date of accident.

•

Note that these earnings are GROSS earnings and include overtime and tips, before any deductions are

made for taxes or Social Security. If there were any perquisites, please list the TOTAL value

separately at the bottom of the chart.

•

If an injured employee lost more than seven consecutive calendar days, although not in the same week,

these periods should be noted on the Wage Chart (VWC Form No. 7-A) using an asterisk in the

Week No. column and are not to be counted in the calculations. Va. Code § 65.2-101.

•

If injured employee has worked less than 12 months, the earnings for the time worked should be used.

The earnings for a similar employee may be used if the employee has worked less than 60 days.

How to calculate the Wage Chart

:

•

If a full year’s wage information has been provided covering the 52 week period prior to the date

of accident:

- determine the total wages earned, including yearly perquisites;

- divide the total wages earned for this period by 52;

- the sum will be the average weekly wage.

•

If a full year’s wage information has not been provided covering the 52 week period prior to the

date of accident:

- determine the total wages earned, including yearly perquisites;

- divide the total wages earned by the number of weeks wages were earned (Note: if warranted,

the weeks can be converted into days and calculated on that basis);

- the sum will be the average weekly wage.

•

If the form is completed on a bi-weekly basis:

- determine the total wages earned, including yearly perquisites;

- divide the total wages earned by the number of weeks worked (employee

paid 26 times a year represents 52 weeks of wages);

- the sum will be the average weekly wage.

•

Samples of properly completed wage chart(s) are available through the Commission’s Website at

under the forms menu.

•

For questions or assistance with completing this form, please contact the Awards Unit using the

Commission’s Toll-Free number at (1-877) 664-2566.

1

1 2

2